US stocks turned lower after the Federal Reserve’s latest rate decision and Chair Jerome Powell’s speech signaled the central bank sees work left to do in its battle against inflation.

(Bloomberg) — US stocks turned lower after the Federal Reserve’s latest rate decision and Chair Jerome Powell’s speech signaled the central bank sees work left to do in its battle against inflation.

The S&P 500 and the Nasdaq 100 erased earlier gains after the Fed raised its benchmark rate by half a percentage point and Powell restated his hawkish stance.

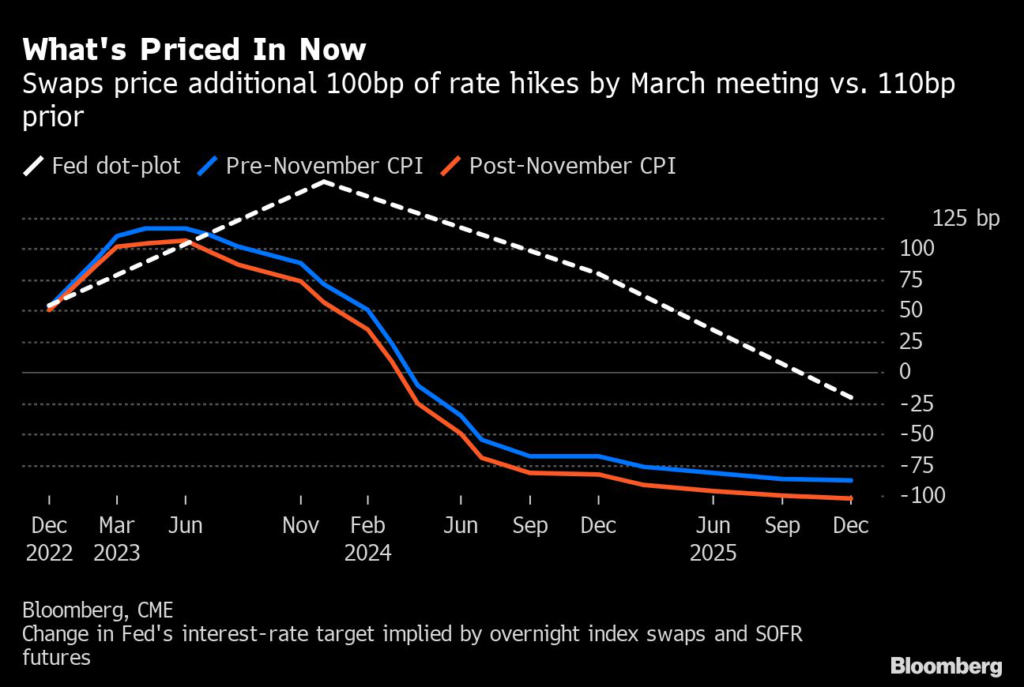

Stocks had rallied more than 6% since the last rate decision on the expectation that the central bank would be able to slow and possibly stop its tightening next year. That view took a hit with officials’ latest projections that the Fed funds rate will top 5% in 2023, before being cut to 4.1% in 2024.

The policy-sensitive two-year Treasury yield pared its climb. The dollar dropped, after briefly strengthening as the Fed announced its decision.

Powell restated that policy will need to remain tight for “some time” to restore price stability. He provided no dovish relief and emphasized that the Fed needed more evidence beyond October and November’s softer consumer price index numbers to have confidence that inflation is coming down meaningfully. He also said that the size of February’s rate hike depend on incoming data.

“The Fed still remains coy about the possibility of recession, but with most Fed officials considering risks to be tilted to the downside, it’s fair to say they are far more worried about the economic outlook than they are willing to admit,” said Seema Shah, chief global strategist at Principal Asset Management. “This should mark the death knell for the most recent bear market rally.”

Key events this week:

- China medium-term lending, property investment, retail sales, industrial production, surveyed jobless, Thursday

- ECB rate decision and ECB President Lagarde briefing, Thursday

- Rate decisions for UK BOE, Mexico, Norway, Philippines, Switzerland, Taiwan, Thursday

- US cross-border investment, business inventories, empire manufacturing, retail sales, initial jobless claims, industrial production, Thursday

- Eurozone S&P Global PMI, CPI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.9% as of 2:56 p.m. New York time

- The Nasdaq 100 fell 1.1%

- The Dow Jones Industrial Average fell 0.7%

- The MSCI World index rose 1.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.4% to $1.0675

- The British pound rose 0.3% to $1.2406

- The Japanese yen rose 0.2% to 135.26 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $17,800.33

- Ether fell 0.9% to $1,308.05

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.48%

- Germany’s 10-year yield advanced one basis point to 1.94%

- Britain’s 10-year yield advanced one basis point to 3.31%

Commodities

- West Texas Intermediate crude rose 2.6% to $77.32 a barrel

- Gold futures fell 0.5% to $1,815.90 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Srinivasan Sivabalan, Isabelle Lee and Emily Graffeo.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.