The declines in Swedish housing prices extended to the eighth straight month, as the worst slump in three decades deepens.

(Bloomberg) — The declines in Swedish housing prices extended to the eighth straight month, as the worst slump in three decades deepens.

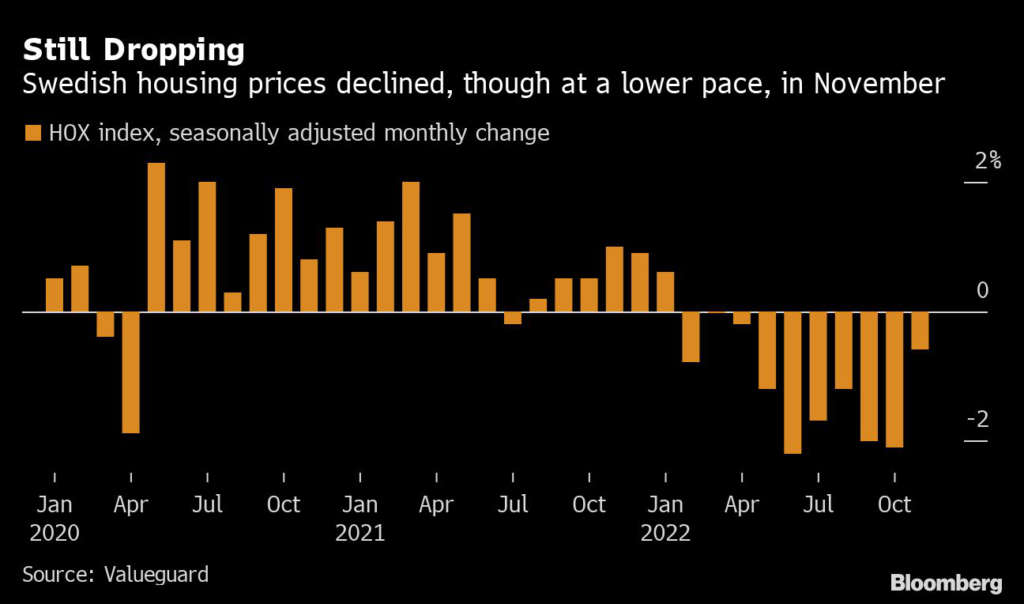

Prices have now declined by 15% since a March peak, according to the HOX housing index from Valueguard, which compiles the data. The rapid slide has made Sweden emblematic of a development that is playing out in countries around the world as consumer prices soar and borrowing costs rise.

Most forecasters predict a 20% slump from the highest levels, which would erase outsized price gains during the pandemic. In a more adverse scenario, with rapidly rising unemployment and larger-than-expected interest-rate increases by the Riksbank, Sweden’s central bank, the slide could be deeper and more protracted.

A number of indicators track the housing market in the biggest Nordic country, and earlier this month state-owned mortgage lender SBAB said its data indicated at 15% drop from the peak.

The value of homes is expected to continue sliding, following November’s 1.4% monthly decline. Still, seasonally adjusted, the 0.6% decline in November is the smallest since April and some realtors are now saying that they are seeing tentative signs of the housing market being on a path to stabilization.

“We notice that the worst distress has abated in many areas, and that is most obvious in Stockholm,” Marcus Svanberg, chief executive of Lansforsakringar Fastighetsformedling, said in a statement. “However, it remains hard for sellers to get used to the fact that the value of their homes has declined and that means sales take longer and supply remains high.”

Extended Slide

Analysts concur with the warnings that the downturn is likely to extend into next year, with SEB’s Chief Strategist Jussi Hiljanen calling it “surprising if the decline in housing prices does not continue for some time.”

Commenting on the Valueguard data, Nordea’s Gustav Helgesson said that households’ price expectations and consumer confidence “remain at historically low levels, indicating further weakness.”

“Furthermore, the Riksbank has not concluded its hiking cycle, indicating that households have yet to fully adjust to rising living expenditures,” he said. “We thus expect the decline to continue until this summer.”

–With assistance from Joel Rinneby.

(Adds analyst comments from seventh paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.