UK stockpickers have had a year to remember.

(Bloomberg) — UK stockpickers have had a year to remember.

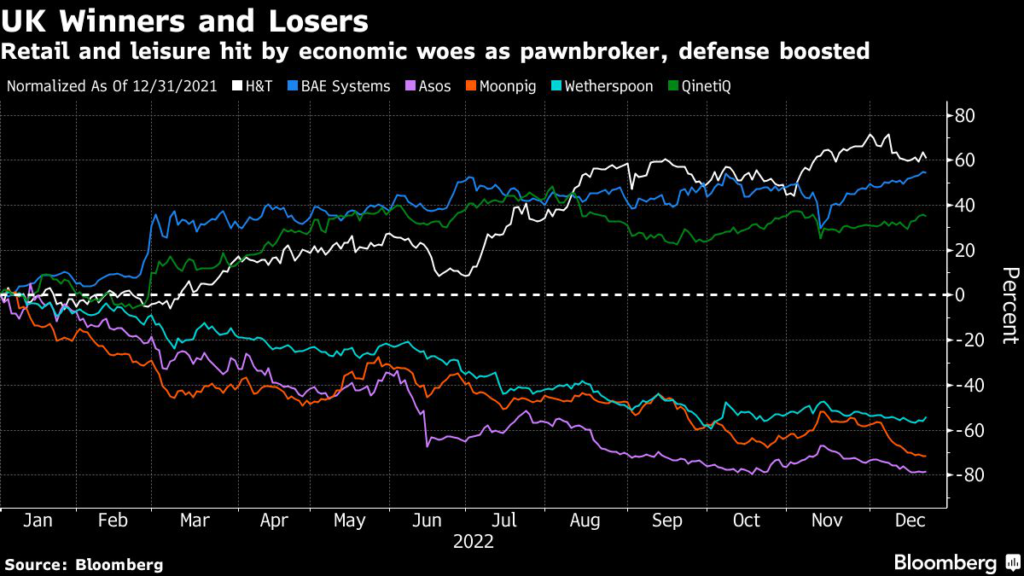

Recession, inflation, two prime ministers resigning and a wave of strikes have sparked selloffs in domestic stocks. The cost-of-living crisis has been a dream for pawnbrokers, but a disaster for pubs and some retailers. Meanwhile, Russia’s invasion of Ukraine has contributed to rampant energy prices but also created huge demand for defense spending. The FTSE 250 midcap index is down 20% year-to-date, the most since 2008.

Below is a look at some of the best and worst-performing stocks of the past 12 months:

Losers

- Asos (-79%) – Retail

The cost-of-living crisis is taking its toll on online retailers, with traffic on the websites of firms like Asos Plc dropping considerably this year, according to JPMorgan Chase & Co. analysts. Bloomberg reported that it’s also considering hiring a restructuring expert.

Asos is the worst-performing stock on the FTSE 350 Retail Index this year, and at about 17 times estimated earnings, it’s almost as cheap as it’s ever been.

Its woes are in stark contrast to Frasers Group Plc, which has significantly outperformed the index.

- Aston Martin Lagonda (-69%) – Autos

It’s been a volatile ride for loss-making Aston Martin Lagonda Global Holdings Plc since its high-profile 2018 public offering. Orders have been robust but production has been hit by higher costs and delays in obtaining parts for cars. Once touted as a peer to Ferrari NV, Aston Martin’s finances have been pressured by the company’s high-interest debt load.

Bloomberg Intelligence analyst Michael Dean anticipates that 2023 will be a “transition year,” with the incumbent sports car range being phased out against a backdrop of macroeconmic uncertainty.

- 888 Holdings (-72%) – Gambling

Shares of 888 Holdings Plc have been hit by investor concerns over the financing its acquisition of William Hill Ltd.’s international assets. In December, 888 and its lenders were still looking to offload debt with the company issuing new junk bonds.

The gambling sector is still reeling from a crackdown on UK player safety measures earlier this year, which sliced 10% off 888’s online revenue year-on-year. In 2023, analysts will be keeping a close eye on how gambling companies will adapt their strategies to account for these losses.

At less than 6 times estimated earnings, 888 trades just above its cheapest level ever.

- Moonpig (-71%) – Retail/Tech

Unfortunately for Moonpig Group Plc, birthday cards aren’t recession-proof. A tough economic outlook combined with UK postal strikes have hit the firm, which is raising prices and cutting marketing spend. Rising interest rates have weighed on internet-based stocks because of consumers’ lower spending power.

While Moonpig is raising prices and cutting marketing spend, the firm has a challenging year ahead, according to Jefferies analyst Andrew Wade and Grace Gilberg.

The stock trades at less than 9 times estimated earnings, down from a peak of more than 50 times last year.

- Wetherspoon (-54%) – Restaurants

There seems to be no end to JD Wetherspoon Plc’s Covid hangover. After the pandemic, older customers in particular failed to return to the British pub chain in previous numbers, and now rising energy prices, cost-conscious customers, train strikes and higher rents because of rising interest rates are taking their toll.

Pub closures and staff layoffs have characterized 2022, which Deutsche Bank described as a “lost year” for British pubs. And with train strikes into next year threatening to impact pub sales, 2023 is already presenting a bleak prospect for Wetherspoon.

The shares trade at around 15 times estimated earnings versus the FTSE 250’s 10 times.

- Synairgen (-93%) – Healthcare

Synairgen Plc is a loss-making pharmaceutical firm that soared more than 2,500% in 2020 on hopes that its inhaler-based experimental drug could help treat Covid-19. The AIM-listed stock tumbled after the treatment failed to meet key targets in a trial.

Winners

- H&T (+60%) – Pawnbrokers

Inflation and rising energy prices have resulted in more people looking for ways to get cash, and British pawnbroker H&T Group Plc has been one of the best-performing stocks on the AIM junior market.

Shore Capital analyst Gary Greenwood sees further upside potential, saying that a withdrawal of smaller competitors from the market provides room for more growth.

Even after the rally, H&T only trades at about 8 times estimated earnings, down from 16 times in 2016.

- BAE Systems (+56%)/QinetiQ (+37%) – Defense

Shares in British defense company BAE Systems Plc spiked in March following Russia’s invasion of Ukraine, with the war forcing governments to boost their defense spending. Peer QinetiQ Group Plc has also risen strongly.

BAE trades at about 15 times estimated earnings, up from about 8 times two years ago.

- Pearson (+53%) – Publishing

Pearson Plc’s pivot toward digital learning is bearing fruit at a time when it’s pressured by weaker book sales in its higher education segment. A cost savings program unveiled in August gave investors another reason to cheer. The company rejected two takeover offers from private equity firm Apollo Global Management Inc.

Pearson trades at about 16 times estimated earnings, well below the 24 times seen last spring.

- Balfour Beatty (+30%) – Engineering and construction

Balfour Beatty Plc’s performance is largely thanks to a series of big projects such as a Hong Kong International Airport contract and the High Speed Two rail program in the UK. The British construction group has enjoyed robust margins, generated high revenues and improving profitability, which are set to continue through to 2023.

Balfour trades at about 11 times estimated earnings, up from 8 times earlier this year.

- ME Group International (+76%) – Photo Services

Booming demand for passport pictures amid a resumption of travel lifted self-service photo booth operator ME Group International Plc, formerly known as Photo Me. Trading in Asia continues to be subdued due to some pandemic measures remaining in place, the firm said last month, and sales stand to gain once pandemic measures are finally relaxed.

The shares trade at about 9 times estimated earnings, down from 11 times earlier this year.

–With assistance from Henry Ren.

(Adds further analyst commentary, valuation metrics throughout.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.