(Bloomberg) — European Central Bank Vice President Luis de Guindos said interest-rate hikes like the half-point move seen at this month’s meeting may become the standard as officials maintain their fight with soaring inflation.

(Bloomberg) — European Central Bank Vice President Luis de Guindos said interest-rate hikes like the half-point move seen at this month’s meeting may become the standard as officials maintain their fight with soaring inflation.

Despite forecasts for a winter recession in the 19-nation euro zone, monetary-policy tightening must continue, Guindos told France’s Le Monde in an interview published Thursday on the ECB’s website.

“Increases of 50 basis points may become the new norm in the near term,” Guindos said. “We should expect to raise interest rates at this pace for a period of time.”

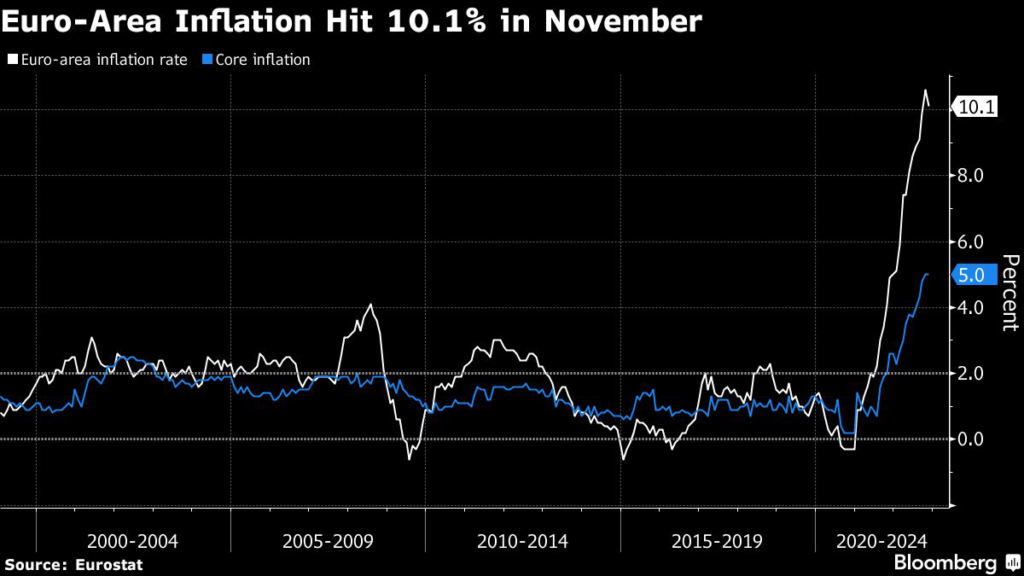

While delivering a smaller hike at its most recent meeting, the ECB’s rhetoric has remained hawkish. Economists have lifted their forecasts for both how quickly rates will rise and how high they’ll end up. Inflation, despite dipping for the first time in 1 1/2 years in November, is more than five times the 2% target.

“Our interest rates will then enter into restrictive territory,” Guindos said. “The steps we have taken so far are going to have an impact on inflation, but we still need to do more.”

The fastest price gains since the euro was introduced more than two decades ago may peak this quarter, Governing Council member Mario Centeno said Wednesday, though he called more rate hikes “inevitable.”

The Bank of Greece warned this week that lifting borrowing costs results in a “policy dilemma” because of the drag on economic expansion.

Speaking to Skai radio in an interview broadcast Thursday, Bank of Greece chief Yannis Stournaras said the ECB’s deposit rate may rise to 3% by March from 2% now.

–With assistance from Sotiris Nikas.

(Updates with Greek central bank governor in final paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.