Blue-chip companies are expected to storm the bond market in January before funding costs increase and the economy deteriorates.

(Bloomberg) — Blue-chip companies are expected to storm the bond market in January before funding costs increase and the economy deteriorates.

US investment-grade bond sales are forecast to jump as high as $40 billion in the first week of 2023, more than four times what was issued in all of December. January is typically busy for borrowers and a drop in funding costs from recent peaks should spur them to get ahead of higher rates and what could be a hard landing in the US.

“As a borrower, you have to look at every possible window and know that, particularly in the first-half of the year, those windows may be fraught with risk,” said Meghan Graper, global co-head of investment grade syndicate at Barclays Plc.

The Federal Reserve’s inflation fight, the ongoing war in Ukraine and China’s recovery from its Covid-zero policy are expected to keep markets choppy. High-grade debt investors fearing a wave of credit rating downgrades will keep a close eye on earnings as tighter policy weighs.

“Next year will be a year of persistent volatility, but not without opportunities,” Graper said in an interview. “Given the strength of underlying technicals, investment grade [debt] will be able to weather the storm.”

This year saw a record number of days with no corporate bond sales because of heightened volatility. Bank of America Corp. expects a boost to 2023 issuance from some of those deals coming back, and also predicts stronger investor demand, credit strategist Yuri Seliger wrote in a note.

US companies sold nearly $60 billion of high-grade bonds in this year’s first week, according to Bloomberg-compiled data, surpassing projections of about $40 billion. In the corresponding week of 2021 and 2020, volume was $50 billion and $62 billion, respectively.

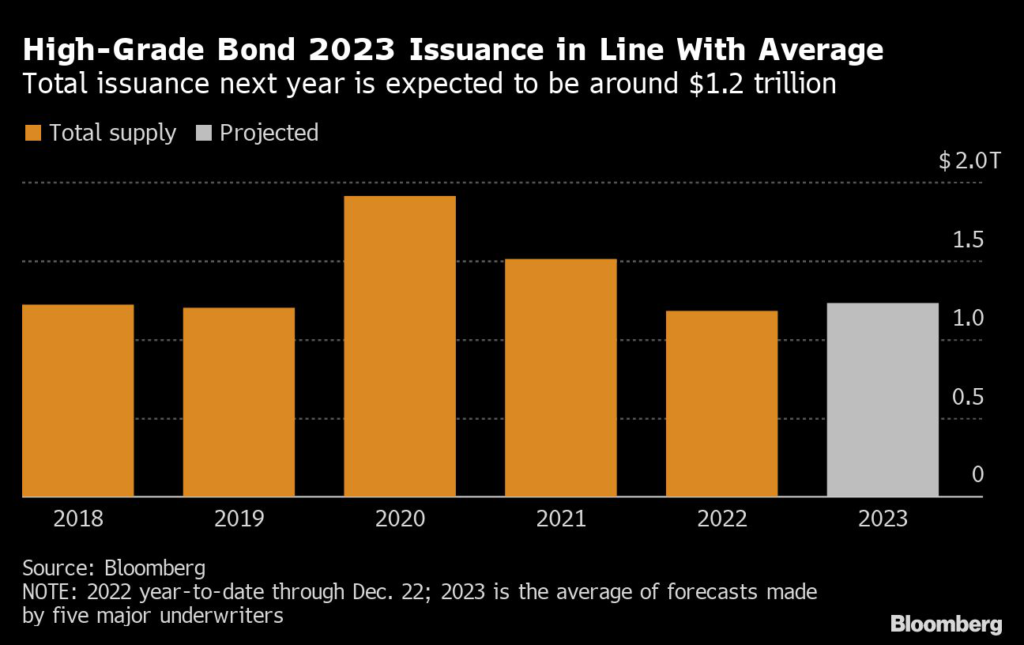

Syndicate desks predict about $130 billion of issuance for all of January, in line with the $126 billion average for the first month of the last 10 years. For all of 2023, Wall Street expects as much as $1.25 trillion in high-grade volume, little changed from 2022, which saw 14% year-on-year decline.

Read more: US HIGH-GRADE BOND OUTLOOK: Returns, Supply and Themes in 2023

Bank Ballast

A large portion of 2022 supply came from the financial sector, especially the big six US banks.

“What was unique about this year was that supply was more heavily weighted to financials with a 55/45 financials-to-corporate split,” said Maureen O’Connor, global head of high-grade debt syndicate at Wells Fargo & Co., in an interview. “This was the first time financial supply outweighed corporate issuance going back over a decade. We think we will see a more balanced split next year, more like 50/50.”

Read more: Big US Banks Set to Sell $132 Billion of 2023 Debt, a 33% Drop

While financial issuance could moderate next year, debt sales tied to mergers and acquisitions may tick up as companies come to terms with higher rates. The loan market is also expected to be active for investment-grade borrowers.

With investment-grade spreads not yet pricing in a recession and yields at highs investors haven’t seen in a while, banks say 2023 will be the year of the bond, particularly high grade — assuming there are no missteps by central banks.

Read more: Company Debt to Rally in What’s Been Dubbed the Year of the Bond

“US dollar investment-grade credit is kind of the best house on the block because you are getting paid very healthy all-in yield and these are bellwether companies that have a long history of managing through multiple cycles,” said Arvind Narayanan, senior portfolio manager and co-head of investment-grade credit at Vanguard Group Inc.

Elsewhere in credit markets:

Americas

Investors seeking higher yields have poured money into private credit for years, turning the asset class into a $1.4 trillion market, but 2023 could be the year that fund managers struggle to raise money for the debt as defaults rise.

- Risky companies shut out of the bond and loan markets and facing looming maturities are likely to turn to private credit for financing in the coming months, creating attractive opportunities for investors, according to Sachin Khajuria, a former partner at Apollo Global Management who now runs his own firm

- Amgen Inc. has borrowed about $4 billion through a term-loan agreement, which may allow the company to raise less cash in the bond market to help fund its purchase of Horizon Therapeutics Plc

- A spike in the number of US charter schools struggling with their debt may foreshadow a rise in defaults in the years ahead

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

A two-part deal for the European Union allowed the SSA sector to lead December’s issuance as marketwide volume reached €16.4 billion ($17.4 billion), according to data compiled and analyzed by Bloomberg.

- Eskom Holdings SOC Ltd.’s auditor said it is concerned that the company may not be able to continue operating and detailed a litany of criminal, wasteful and irregular practices at the stricken South African power utility

Asia

China Evergrande Group sought to extend payment of a yuan bond for a second time as the defaulted property giant inches closer to unveiling a restructuring blueprint.

- JSW Energy, one of India’s largest independent power producers, is seeking as much as 20 billion rupees ($241 million) in green loans to fund its expansion in non-conventional power generation, according to people familiar with the matter

- Sino-Ocean Group’s dollar bond due February 2027 is poised for its biggest fall since Sept. 29, according to Bloomberg-compiled prices

–With assistance from Allan Lopez.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.