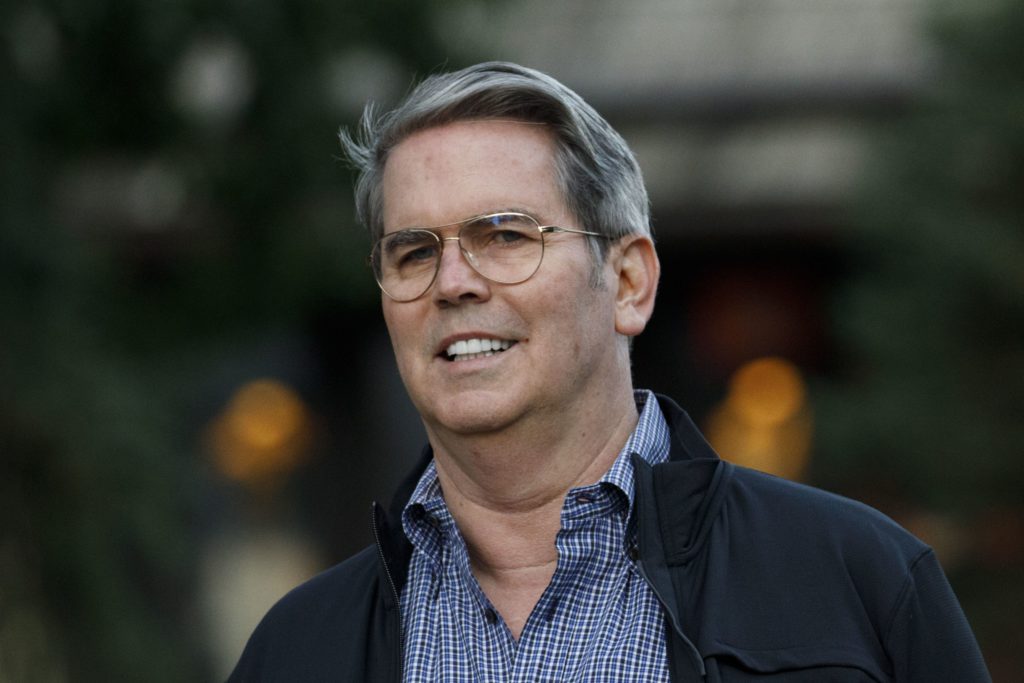

(Bloomberg) — Scott Bessent, a former Soros Fund Management investing chief, posted a 30% gain in his macro hedge fund this year through Tuesday — and he told clients he’s betting on a rising yen, gold and oil in 2023.

(Bloomberg) — Scott Bessent, a former Soros Fund Management investing chief, posted a 30% gain in his macro hedge fund this year through Tuesday — and he told clients he’s betting on a rising yen, gold and oil in 2023.

The Bank of Japan’s surprise decision to widen the yield curve control band for 10-year government bonds marked a “seminal moment for global monetary policy and financial market liquidity,” Bessent, 60, told clients of his Key Square Capital Management in a Dec. 20 letter.

He sees the central bank’s decision as the first step in ending more than a decade of aggressive easing, he said.

Bessent made about 300 basis points in returns on the bet since the BOJ’s Dec. 19 move with positions in long-dated, out-of-the-money yen calls against the US dollar, an investor said, requesting anonymity to discuss Key Square’s performance.

The fund earlier this year gained from wagers on natural resources stocks and short bets on technology and other growth shares, as well as on energy prices.

His Key Square II, a more leveraged version of his fund, climbed 54% this year through Tuesday, the investor said.

A spokesperson for Key Square declined to comment.

It’s been a banner year for many macro funds, with traders including Chris Rokos, Said Haidar and Michael Platt producing some of the top returns. One exception has been Bridgewater Associates, the giant firm founded by Ray Dalio, which gave up much of its gains after losing money in October and November.

Bessent is wagering that the yen will continue its upswing and that global bond markets will struggle until other central banks adopt more neutral policies, he told investors in the letter.

Dollar Dipping

The US dollar, which surged against most currencies this year, is heading for a multi-year decline, he said — especially against the yen, gold and some emerging-market currencies.

In part, that’s because China, Russia, the Gulf Cooperation Council members and other nations have been moving toward less reliance on the US currency.

Gold will benefit from that trend, with emerging market central banks increasing their reserves of the metal.

He also expects yield curves around the world to steepen as Japanese investors sell foreign bonds to bring money back to invest locally.

He’s betting that China’s recent reopening from its stringent Covid lockdown will boost the country’s economy and translate into higher demand for commodities and consumer goods and cause a spike in domestic and foreign travel.

That economic jolt from China, combined with the BOJ’s tightening, will eventually provide “extremely attractive entry points for multi-year long positions in some developed and emerging bond markets,” Bessent said.

Bessent entered 2022 on a two-year losing streak, with his flagship fund falling 5.1% in 2020 and 7.2% in 2021. With increased volatility in currency markets, he has told clients he hopes to outperform.

In late 2012 and into 2013, while at Soros Fund Management, Bessent made 15% shorting the yen. He has told clients he thinks there will be a similar move in the currency again, according to the investor in his fund.

Bessent also told clients he intends to use a portion of this year’s gains to set up a foundation to promote increased financial literacy among students and adults in his home state of South Carolina.

(Adds comments on dollar decline and gold gains in 11th and 12th paragraphs, and plans for a foundation in the last paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.