UK house prices fell for a fourth month, adding to concerns a deeper slump may now be underway.

(Bloomberg) — UK house prices fell for a fourth month, adding to concerns a deeper slump may now be underway.

Nationwide Building Society said its measure of property costs dropped 0.1% in December, marking the longest downturn since 2008 at the end of the global financial crisis.

For 2022 as a whole, Nationwide said property prices finished the year 2.8% above where they were at the end of last year, about a third of the pace of growth in 2021. The average price of a house in December fell to £262,068 ($315,660).

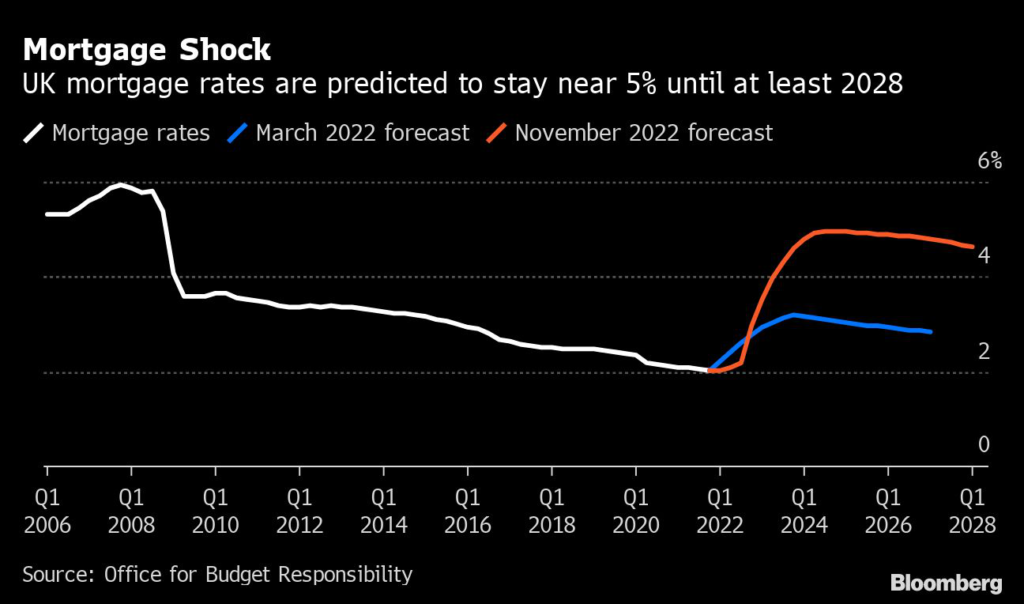

Soaring interest rates and the sharpest cost-of-living squeeze in memory strained affordability for many buyers, whose wages are falling further behind the worst bout of inflation in four decades. Mortgage rates are now near where they were in 2008 when housing costs were in the middle of a 16-month slump.

“It will be hard for the market to regain much momentum in the near term as economic headwinds strengthen, with real earnings set to fall further and the labor market widely projected to weaken as the economy shrinks,” Robert Gardner, Nationwide’s chief economist, said in a statement Friday.

What Bloomberg Economics Says …

“A fourth monthly decline in the UK nationwide house price index shows the housing correction rumbling on in December. We see home values falling nearly 10% in the coming year as higher mortgage rates bite and the biggest squeeze on real incomes in a generation continues.”

—Niraj Shah, Bloombergg Economics. Click for the REACT.

The Bank of England lifted its key rate nine times over the past year, bringing the benchmark to 3.5%, which is also the highest since 2008. That’s set to hit mortgage holders hard, with those who need to remortgage likely to see their monthly payments double.

A separate report from Halifax showed demand for homes falling in London and strengthening outside major urban areas after employers gave workers more flexibility to work from homes.

House prices in London increased at a slower pace than other parts of the country, at 7.2% year on year. York and Woking saw the biggest increases.

Nationwide was more pessimistic on property prices in the capital, saying London’s annual price growth slowed to 4.1% in December, down from 6.7% in the third quarter. Nationwide said East Anglia the strongest performing region last year, and Scotland was weakest.

Gardner said that for now, household balance sheets were in good shape, acting as protection from higher rates. That echos similar comments from BOE Deputy Governor Jon Cunliffe, who said earlier this month that property owners could cope with declines in property values of as much as 20% without distress.

The cost of a two-year fixed rate mortgage now hovers near 5.8% according to Moneyfacts Group Plc. About 4 million UK households will see a substantial increase in the next year, and the Office for Budget Responsibility expects mortgage rates to remain elevated until 2030.

Economists at JP Morgan Chase & Co. and Credit Suisse Group AG are forecasting property prices will drop 10% next year and keep declining in 2024.

The squeeze is rippling out into the rental market as landlords seek to pass higher costs on to tenants. Property website Zoopla reported that the cost of a new rental agreement rose 12.1% in the 12 months to October. The Bank of England this month said some landlords may need to boost rents 20% to recoup higher mortgage costs.

Read more:

- UK House Prices at Risk of 10% Drop in 2023, Economists Warn

- BOE Official Suggests UK Can Tolerate 20% Drop in House Prices

- BOE Says 4 Million Households Face Higher Mortgages in 2023

- Five Charts Show UK Housing Headed for Biggest Drop Since 2008

(Updates with comment and details from the report.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.