European Central Bank President Christine Lagarde indicated borrowing costs will increase again, saying this is required to temper soaring consumer-price growth.

(Bloomberg) — European Central Bank President Christine Lagarde indicated borrowing costs will increase again, saying this is required to temper soaring consumer-price growth.

“At the moment, ECB policy rates must be higher to curb inflation and bring it down to our target of 2%,” Lagarde told Croatian newspaper Jutarnji list. “That process is essential because it would be even worse if we allowed inflation to become entrenched in the economy.”

The ECB raised interest rates by 250 basis-points this year and policymakers including Lagarde have said more hikes are to come, with markets and economists expecting half-point steps at the next two meetings.

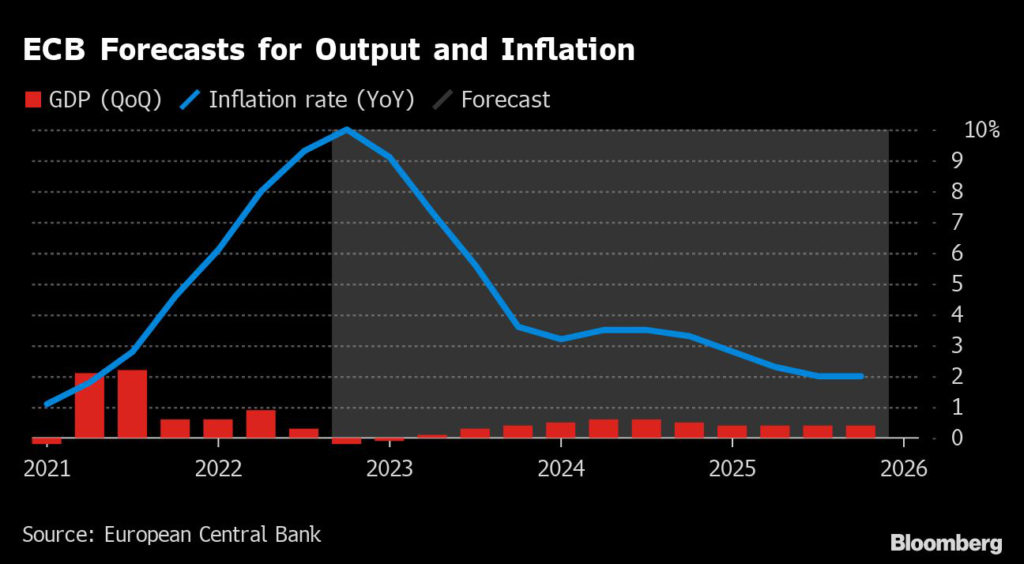

While such rate aggression comes just as an economic downturn takes hold in the region, the ECB president highlighted that the “recession we feared is likely to be short-lived and shallow,” citing her institution’s most recent forecasts.

She also highlighted the ECB’s ever-watchful eye on inflation.

“We must not allow inflationary expectations to become de-anchored or wages to have an inflationary effect,” Lagarde said. “We know wages are increasing, probably at a faster pace than expected, but we must be wary that they do not start fueling inflation.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.