The drop for home prices in Sweden continued unabated in the last month of the year, suggesting that 2023 could offer little relief for an already troubled housing market.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The drop for home prices in Sweden continued unabated in the last month of the year, suggesting that 2023 could offer little relief for an already troubled housing market.

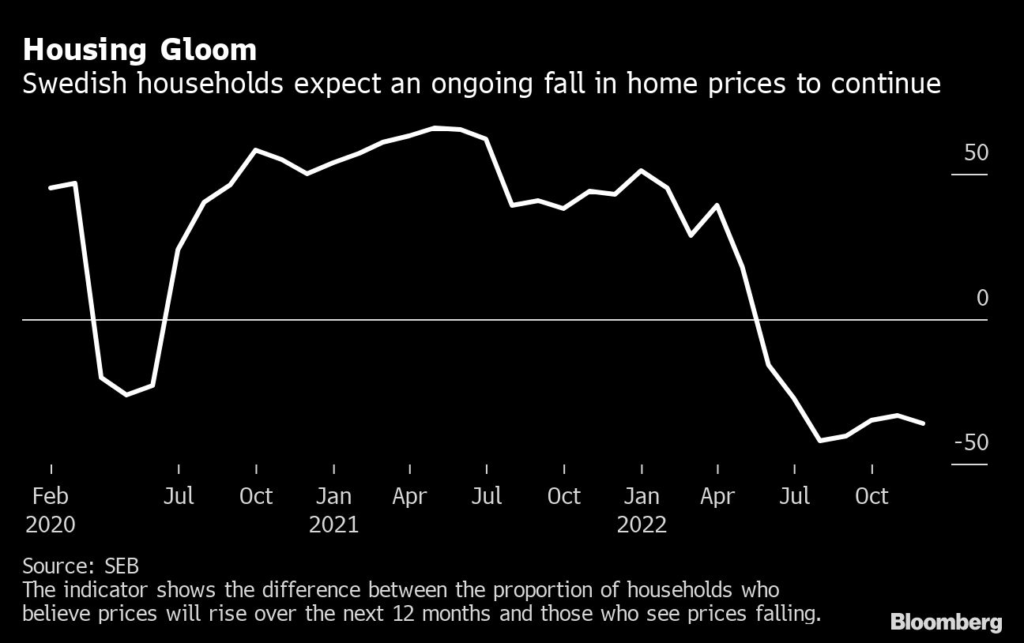

Prices across the country are now down almost 17% since a peak in the spring, according to state-owned mortgage lender SBAB. The worst slump for the market since the 1990s is nearing territory where the 20% forecasts by most economists — including the central bank — are starting to look too conservative.

The Nordic country is far from alone in suffering from falling property values. After booming during the pandemic, central bank interest-rate hikes have triggered a real-estate downturn in a number of nations globally, including in Canada, Australia and New Zealand. In the region, home prices are also falling in Denmark, Norway and Finland, albeit at a much slower pace.

The new data sum up a bad year for Swedish home owners and real-estate firms, who are having to adjust to seeing the value of their properties fall in the wake of the surging cost of living and borrowing, and a gloomy economic outlook.

Swedes are particularly sensitive to interest-rate changes, as roughly 64% of people in the nation of 10 million own their homes, yet most don’t have long-term fixed-rate mortgages. The fast pass-through of four sudden Riksbank rate hikes has exacerbated the market’s woes, with the central bank bringing its key rate to 2.5% in November from zero in April. It’s expected to raise the rate again next month.

Home prices fell 2% in December from the previous month, adjusted for seasonal variations, SBAB said on Monday. That follows a 2.2% decline in November and 2.3% in October, according to an indicator based on transaction data from SBAB’s real-estate listing site Booli.

SBAB has also reported longer listing times on its site as the market has cooled.

Prices for detached houses are now down 19% from the peak in the spring of 2022, while apartment prices have fallen 14%, SBAB said. The larger drop for house prices than apartments is in part explained by high electricity prices, which make it more costly to heat single-family homes.

Still, banks in Sweden are relatively well shielded from the worst distress in the housing market, as lending is based on a borrowers’ capacity to pay off their loans and settling debt on a mortgage is rare. The real risk to lenders is commercial real estate, as commercial property lending accounts for between 16% and 36% of major banks’ loan stocks.

Read More: Sweden’s Housing Market Seeks Bottom as Price Drop Continues

Should unemployment increase significantly “in the wake of the approaching recession,” it could lead to a “very difficult” situation for the housing market if combined with rising mortgage rates, Chief Economist Robert Boije said in the statement. That could then also hit the production of new homes, he said.

There are already signs of the construction industry grinding to a halt, hampered by rising costs and supply-chain hiccups, and a recession forecast for this year portends lower demand.

On Monday, one of the largest landlords said it had no construction starts on new rental apartments in the fourth quarter. Wallenstam AB is waiting for the situation around delivery issues and material prices to clear, Chief Financial Officer Susann Linde said.

“We need to keep an eye on production costs and the supply chain,” she said by phone. “We will gradually increase production when we have secured that.”

(Updates with comments from Wallenstam’s CFO in 12th paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.