It’s been a painful start to the new year for oil bulls.

(Bloomberg) — It’s been a painful start to the new year for oil bulls.

While China’s emergence from Covid Zero spurred talk of a demand boom from some of the market’s biggest names, a significant resurgence in energy consumption remains weeks, if not months away.

Instead, global oil markets have started the year looking much like they did at the end of 2022: oversupplied due to a combination of lackluster demand and robust supply, while simultaneously struggling with thinner trading volumes than historically has been the case.

Add to that a spate of unexpected outages and the result is a market that’s prone to big moves, making it challenging for traders of physical oil barrels to predict which way prices might be headed.

“To me, the market is oversupplied by at least 1 million barrels a day,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “We are going to have large stock builds. In a couple of weeks you’re going to be building 10 million barrels a week, how is the market going to handle that?”

With the near-term oversupply compounded by a swath of US refinery closures following a recent deep freeze, here are some of the reasons why the oil market isn’t yet seeing the benefits of China’s big reopening.

1) The Big Freeze

Shortly before Christmas, a cold snap hammered huge parts of the US, forcing rapid shutdowns of refinery capacity. At its peak, about 40% of Texas’ crude processing capacity was shut down, with a portion of that remaining offline into the first week of 2023.

“We’ve seen these big freeze-offs in the US and that has meant that the crude balance has actually weakened,” Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd., said in a Bloomberg TV interview.

2) Global Slowdown

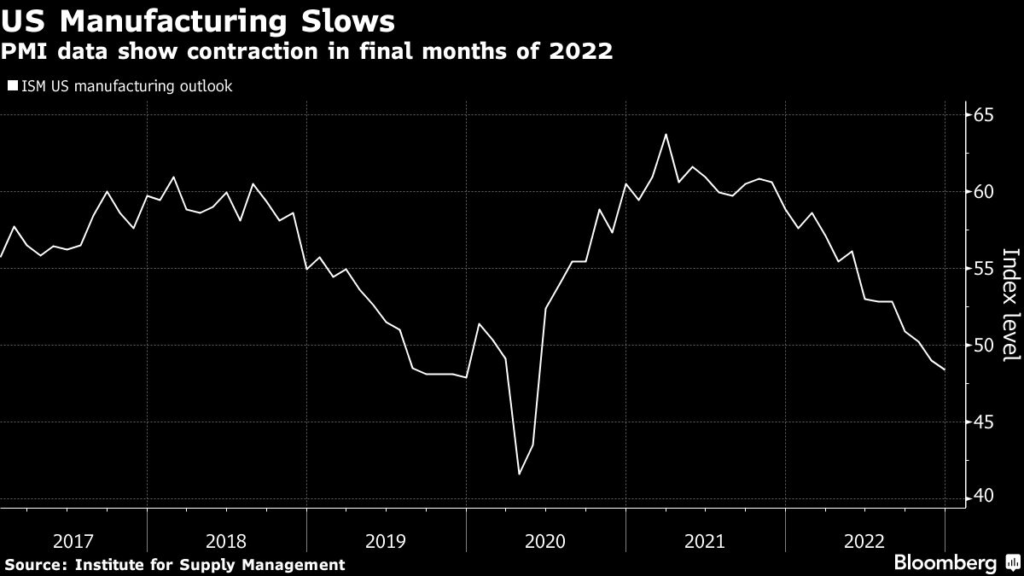

Worries over the health of worldwide consumption continue to linger due to the risk of a synchronized deceleration in the US, Europe and China. On Tuesday, manufacturing figures showed the Chinese economy was in steep decline in late-2022. While mobility has improved in recent days, there are still concerns that the latest surge in infections will lead to further economic slowdown.

In the US, manufacturing figures missed expectations and showed continued contraction Wednesday, while European figures also showed a pullback for December.

3) Seasonal Weakness

The first quarter of the year is typically a time when stockpiles build. The most recent forecast by the International Energy Agency estimated oil supplies at about 600,000 barrels a day above demand in the first quarter, and this was even before the impact of the US cold snap and resultant refinery closures were known.

“The stockbuild in the first quarter is going to be a reflection of first quarter activity and it will be in the doldrums,” Ross said.

Subsequently, warm weather in much of the West has also reduced some pressure across energy markets to meet heating demand. Most of the US is now expected to see warmer-than-normal temperatures from Jan. 10-16, according to the National Oceanic and Atmospheric Administration.

Earlier, crude demand had received a boost as some power generation units switched from gas to oil amid a natural gas shortage.

4) Technical Trouble

For months, the oil market has had to grapple with underwhelming liquidity as soaring volatility and margins pushed open interest to multi-year lows. The retrenchment has left prices susceptible to sharp swings on days when technical traders known as commodity trading advisors, or CTAs, dominate trading.

This week, US crude futures briefly broke above their 50-day moving average, before dropping back below that level — a move that spurred additional technical selling. CTAs were also selling oil during Wednesday’s price drop, people involved in the market said. Momentum-driven selling is also adding to the rout, they added.

5) Demand Destruction

“The abrupt lifting of Covid-19 restrictions and testing requirement since early December and the strong resurgence of infections subsequently have caused demand destruction in recent weeks, especially for gasoline and gasoil,” according to a note from FGE, referring to China.

While major cities such as Beijing, Shanghai and Guangzhou are past their Covid peak, rising cases in inland and rural areas will limit the demand upside in the near term, the industry consultant added.

Beijing has also granted another generous allocation of fuel export quota to refiners this year, prompting traders and analysts to forecast much of the demand boost from China would come in the later months.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.