European bond traders face greater volatility in early 2023 as governments look set to sell record volumes of debt to a market no longer propped up by central bank purchases.

(Bloomberg) — European bond traders face greater volatility in early 2023 as governments look set to sell record volumes of debt to a market no longer propped up by central bank purchases.

January tends to be a big month of the year for sovereign bond sales in any case, and the impact is going to be exacerbated this time around by a lack of buying by the European Central Bank. Net government supply will climb to a record of nearly €500 billion ($530 billion) in 2023, according to Barclays Plc.

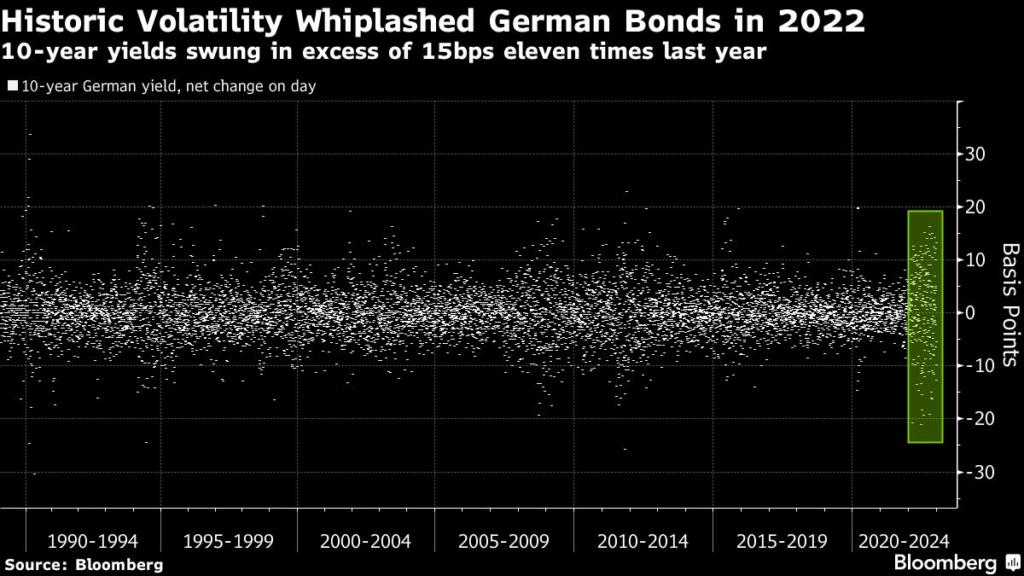

That will test dealers’ capacity to handle risk, increasing price swings and leading to higher borrowing and trading costs, according to market players. There have already been some hallmark signs that liquidity conditions have worsened as investors struggle to buy and sell in large volumes without moving markets.

“There will be a big test of market liquidity,” Tom Prickett, head of rates trading for Europe, Middle East and Africa at JPMorgan Chase & Co., said in an interview. “The tone of the first half of the year is often set by how the market absorbs supply at the start of the year.”

Market depth, even for the most liquid bonds such as German bunds and U.S. Treasuries, has been hovering at historically low levels in the past six months, according to JPMorgan strategists. Bond liquidity has been deteriorating for years after regulations that followed the great financial crisis curbed banks’ ability to make markets. That exacerbates the swings prompted by central banks’ rapid interest-rate hikes to curb inflation.

The year started with a sharp rally, driving benchmark yields down the most in two months on bets inflation is slowing. The first syndicated sovereign sales of the year, from Austria, Slovenia and Ireland showed signs of strength, while a French 10—year auction Thursday looked robust. Still, the looming flood of debt means the market could be vulnerable to a reversal. Bonds slid on Thursday.

While investors may be paying little attention to financial stability concerns at the moment, the euro-zone market is exposed to dislocations given the risk of fragmentation between different issuers, said Ralf Preusser, head of the global rates strategy at Bank of America.

For governments, this may mean they have to tweak their issuance strategies. Germany, after experiencing some weaker bond sales in 2022, may need to consider measures to ensure success such as offering leading banks so-called greenshoe options, said Dalibor Jarnevic, head of government bond trading at DZ Bank, which gives banks the right to buy more bonds after the auction at the same price.

“We are going to have to live in a world where we won’t have a central bank buyer,” said Anthony Linehan, deputy director at Ireland’s debt management office, at a recent conference. “We will have to be more sensitive to where the market is at the time we want to issue. We may need to flex a bit more.”

ECB Absence

For investors, the key question is who is going to replace the ECB — with buybacks worth €270 billion last year — as a major buyer, said Priya Misra, the head of rates strategy at TD Securities, which sees net supply more than doubling this year. Japanese funds will probably be less interested after the Bank of Japan tweaked its bond-yield control to allow long-term yields to rise more, she said.

It’s unlikely to be local banks in Europe either. The cheap loans provided to them by the ECB under the so-called TLTRO program, some of which were used to buy government bonds, are being paid back.

“It will ultimately come down to asset managers,” said Misra. “We think duration risk will look attractive heading into a recession.”

Demand from pension funds may cool because of improved funding conditions and planned reforms. From July, Dutch pension funds will be allowed to make a transition to new defined contribution-based contracts. This will be a slow process, but it will reduce liabilities for pension funds, and therefore the need to buy bonds for hedging, she said.

Higher-yielding euro zone bonds “might become more interesting to other kinds of investors,” said DZ Bank’s Jarnevic. “Still, there’s uncertainty about how much of this increased government bond issuance can really be absorbed.”

(Updates with French and Irish bond sales in 6th paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.