BYD Co. launched the first of two new luxury electric-vehicle brands it is introducing this year, looking to broaden its rapidly expanding reach by shifting into the premium car segment.

(Bloomberg) — BYD Co. launched the first of two new luxury electric-vehicle brands it is introducing this year, looking to broaden its rapidly expanding reach by shifting into the premium car segment.

The Shenzhen-based company unveiled its U8 sports utility vehicle, which falls under the Yangwang brand, at a press conference Thursday. BYD said the SUV would be at the “million yuan” level, without providing further details. That would make it one of the most expensive EVs on the road in China. Tesla Inc.’s Model Y SUV has a base price of 288,900 yuan ($42,030).

By expanding into higher priced EVs aimed at wealthier buyers while bolstering and renewing its existing lineup, BYD is increasingly encroaching upon market leader Tesla, which churns out around 70,000 EVs a month from its factory in Shanghai. BYD also unveiled a luxury electric sports sedan, the U9, on Thursday.

Outside of technical specs not a lot of other details were provided on the vehicles, though BYD said the U8 has four electric motors as well as the automaker’s signature blade batteries, and it can drive in water in emergencies. BYD has previously teased the safety capabilities of its new luxury marque, with footage of driving in icy conditions and with a puncture.

Warren Buffett-backed BYD’s sales of new-energy vehicles — including pure electric cars and hybrids — climbed to 1.86 million last year from about 604,000 in 2021, even as Covid impacted production.

A top BYD executive said in December that output was curtailed by at least 2,000 cars a day and that 20% to 30% of employees were unable to work and quarantining at home. Sales of its pure-electric cars fell month-on-month in December for the first time since February.

While sales of regular passenger cars in China aren’t rising as strongly as in the past, rising just 1.8% to 20.7 million in 2022, demand for EVs is holding up. China’s Passenger Car Association estimates around 6.5 million EVs were sold last year and predicts that figure could rise to at least 8.4 million in 2023.

BYD is “resilient thanks to long order backlogs and a stable supply chain,” said Jing Yang, a corporate research director at Fitch Ratings Inc. “We look forward to BYD’s overseas expansion and the new brands to be launched in 2023, which should enhance value.”

The company, which also produces batteries and semiconductors, hasn’t yet said where the new luxury brands will be sold.

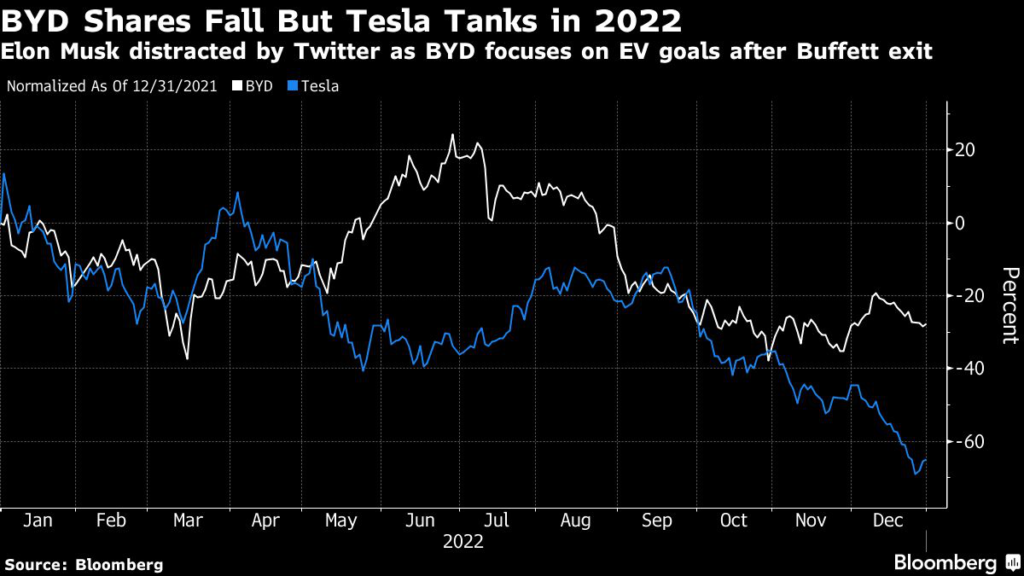

BYD shares have risen 7.9% in the first three trading days of the year in Hong Kong, following a drop of 28% in 2022. Tesla slumped 65% last year and then tumbled 12% Tuesday after delivering fewer EVs than expected last quarter.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.