(Bloomberg) — Venezuela could soon enter another hyperinflationary period as President Nicolas Maduro cranked up the money-printing press to increase spending at year-end, according to private estimates.

(Bloomberg) — Venezuela could soon enter another hyperinflationary period as President Nicolas Maduro cranked up the money-printing press to increase spending at year-end, according to private estimates.

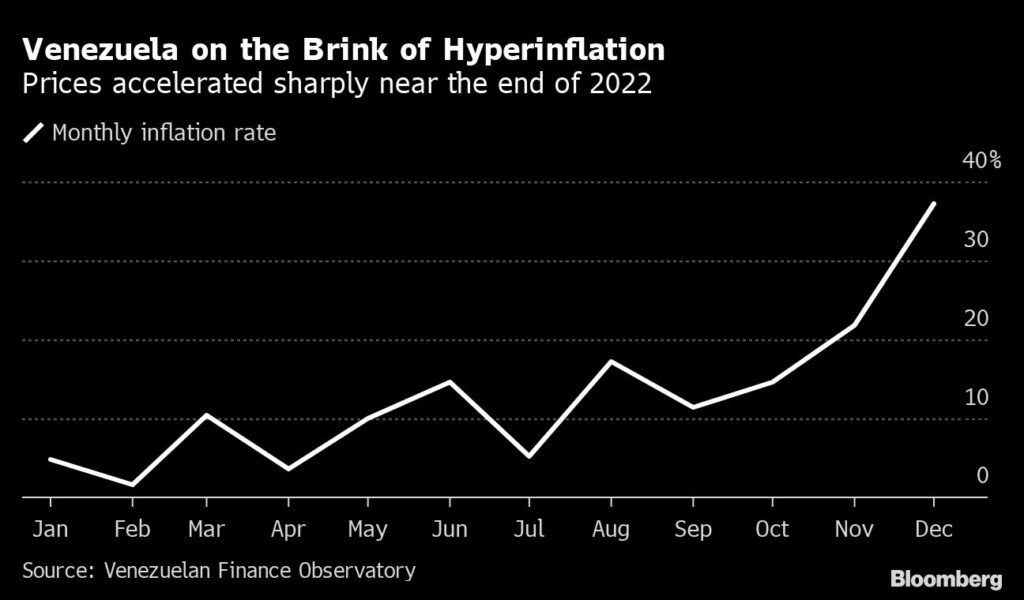

Data from a private research group shows that the nation’s consumer price index likely rose by 37% in December from the month prior, with items such as clothing and restaurant meals jumping more than 50%, the monthly threshold most economists use to determine hyperinflation. The data from the Venezuelan Finance Observatory, which is led by opposition legislators, also showed food prices increased 49% on the month while annual inflation reached 306%.

Bloomberg’s own Cafe con Leche index, which tracks the price of a cup of coffee, jumped 53% in December. Venezuela’s central bank hasn’t published official inflation figures since October.

Last year, Maduro’s economic advisers managed to steer the economy out of one of the longest hyperinflation bouts in history by severely restricting government expenses, limiting banks’ lending capacity and selling billions of dollars in the foreign exchange market to contain the local currency’s depreciation. But the bolivar’s value tumbled at the end of last year as the government handed out Christmas bonuses and limited the supply of foreign currency.

Read More: Venezuela Breaks One of World’s Longest Hyperinflation Bouts

An unexpected drop in oil prices in the second half of last year left the government with a fiscal crisis that is putting pressure on prices, said Angel Alvarado, senior fellow at the University of Pennsylvania and founder of the Finance Observatory.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.