The surge in Chinese builders’ stocks and dollar bonds isn’t over as buying momentum driven by supportive government policy is likely to persist, investors say.

(Bloomberg) — The surge in Chinese builders’ stocks and dollar bonds isn’t over as buying momentum driven by supportive government policy is likely to persist, investors say.

The recovery has been driven by a raft of measures aimed at stemming the country’s property debt crisis and home sales slump. More steps could be on the way as China is planning to dial back the stringent “three red lines” policy that curtailed borrowing in the sector and exacerbated the nation’s real estate meltdown.

“This is a signal from the top regulators in an attempt to help restore market confidence in the real estate sector and create a positive feedback loop between homebuyers, developers and the physical market,” said Zerlina Zeng, senior credit analyst at CreditSights.

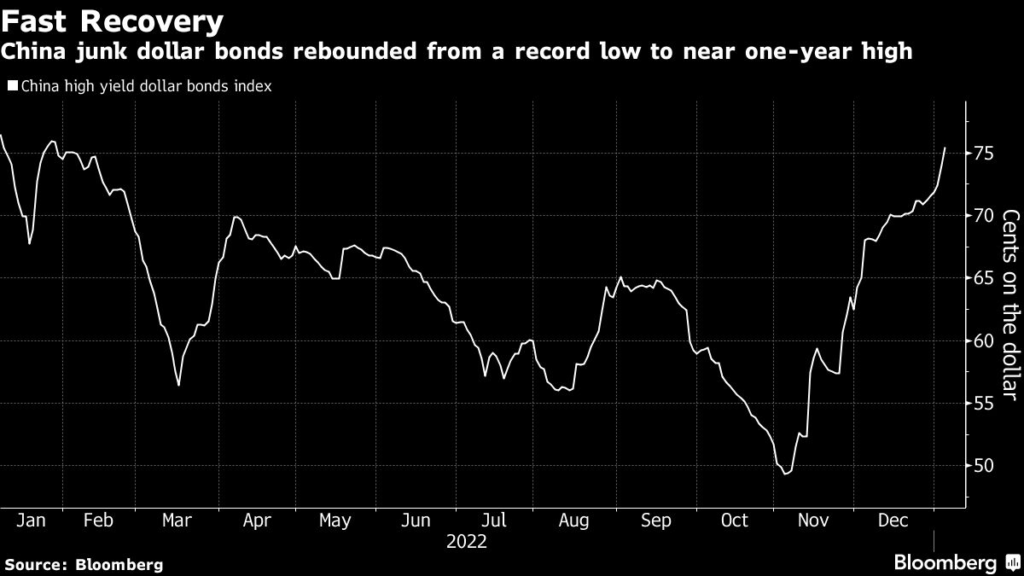

Prices for high-yield notes, a sector dominated by property firms, have reached levels last seen in January 2022 at an average 75 cents on the dollar, according to a Bloomberg index. They bottomed Nov. 3 at a record low of 49 cents. Meanwhile, a Bloomberg Intelligence gauge of builders’ stocks has soared more than 70% from an 11-year low, climbing 2.4% Friday. But morning gains of at least 1 cent for developers’ dollar bonds were erased by midday on profit-taking, according to credit traders.

“China property dollar bonds will continue to ride on the momentum for some time, and we don’t expect to see any major negative news for the sector in the near term,” said Wonnie Chu, managing director of fixed income at Gaoteng Global Asset Management Ltd. “Investors in the dollar-bond market have been chasing yields as well, which helped this rally.”

JPMorgan Chase & Co. stock analysts wrote this week that more easing news “could drive short-term excitement in January” for real estate names before a possible February pullback.

It’s been a drastic reversal from the dark clouds hanging over the sector since mid-2021, when new-home sales began falling in China and regulators’ debt crackdown triggered a cash crunch for developers. The fallout included a record amount of offshore-bond defaults and projects being suspended as builders ran low on cash.

The rally in their stocks and debt has occurred the past two months despite residential sales continuing to sharply decline. The weakness accelerated at China’s largest builders in December, according to preliminary data, underscoring the challenge to stem the downturn at a time Covid-19 infections have soared.

China said late Thursday that it would allow an extension of lower mortgage rates for first-time homebuyers under certain conditions, while the housing minister made a fresh pledge to help builders’ financing needs.

Nomura Holdings Inc. analysts expect the central government will keep rolling out “demand-side policies in the next few months,” potentially easing home-purchase restrictions and down-payment requirements.

Authorities also plan more measures to ease liquidity stress at some of the nation’s largest builders, according to people familiar with the matter.

“The latest headlines suggest that Chinese policy makers are set to draw the line, particularly for some of the ‘too big to fail’ developers,” Citigroup Inc. strategists wrote in a report this week. “We therefore still see upside in current Chinese developers’ bond valuations.”

But the recent default by builder Times China Holdings Ltd. shows that government help may not be a panacea.

“I don’t believe all of the names rebounding will be survivors,” said Gaoteng’s Chu. “For those lacking solid funding channels, we will take profit gradually.”

–With assistance from John Cheng and Finbarr Flynn.

(Updates throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.