Panasonic Holdings Corp. will boost its investment in China significantly, bucking the growing trend of foreign companies reducing their exposure to the country as geopolitical tensions rise and the domestic economy slows.

(Bloomberg) — Panasonic Holdings Corp. will boost its investment in China significantly, bucking the growing trend of foreign companies reducing their exposure to the country as geopolitical tensions rise and the domestic economy slows.

The company will invest more than 50 billion yen ($373 million) in China through the end of 2024 to build and expand factories making home appliances for the local market, the Nikkei newspaper reported Friday, without citing any sources. The company will allow key decisions to be made locally and develop products tailored for the Chinese market in a bid to boost sales, the Nikkei said.

A Panasonic spokeswoman confirmed to Bloomberg News that the company will invest more in China, adding that the Nikkei story was based on an interview. However, she couldn’t confirm the amount of the investment, saying it was based on the Nikkei’s own reporting.

China is the largest trading partner for Japan as well as an important market for Japanese companies, from Toyota Motor Corp. and Sony Group Corp. to Uniqlo.

However, since the pandemic broke out in 2020, the government in Tokyo has encouraged companies to reduce their dependence on production and supply chains in China. Rising tensions between Tokyo and Beijing — as well as between the US and China — are affecting corporate investments and business decisions.

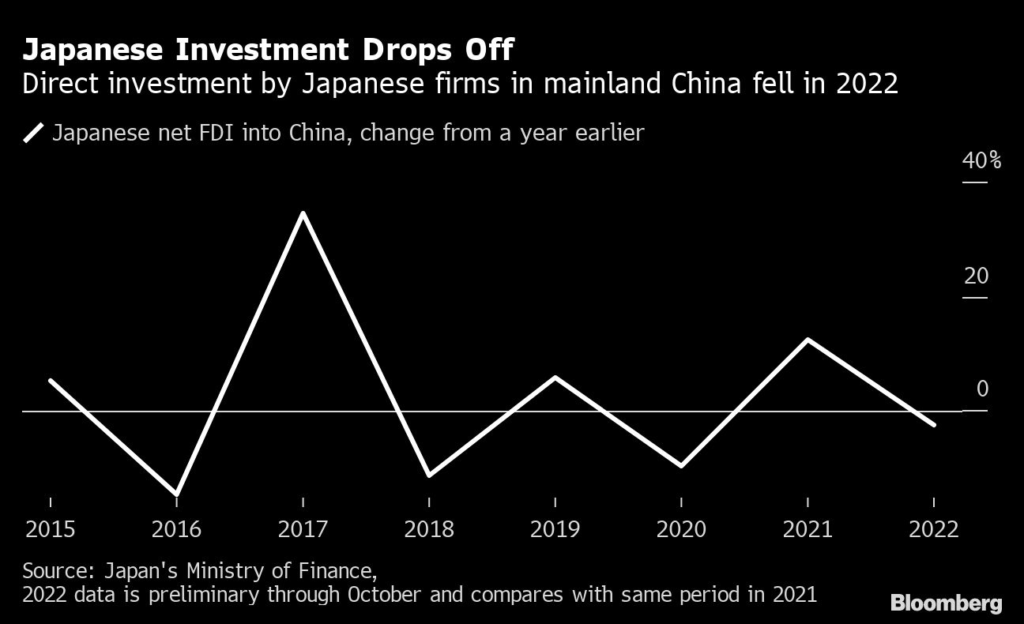

In the first 10 months of 2022, Japanese companies cut new investments by more than 2% from the same period in 2021, according to preliminary data from the Ministry of Finance. That decline may continue, with more than half of major Japanese manufacturers surveyed by the Nikkei late last year saying they planned to reduce their reliance on China as a supplier of parts.

Relations between Tokyo and Beijing have worsened in recent years. An unresolved territorial dispute, tensions over Taiwan and increased Chinese military spending are all seen by Japan as concerns.

The latest Japanese defense strategy described China as an “unprecedented strategic challenge.” Japan’s Minister of Economy, Trade and Industry Yasutoshi Nishimura said this week that he wanted the Group of Seven advanced economies to take a coordinated approach this year aimed at preventing the “economic coercion” that China has applied to some of its trading partners.

In addition, Japan is in talks with the US about whether it will impose further restrictions on the export of equipment to make computer chips. People with knowledge of those talks say there’s an in-principle agreement for Japan to adopt at least some of the controls the US has imposed.

Such a move might further damage ties with China. The nation’s leaders met in November to try and start improving relations, but a follow-up visit involving the Japanese foreign minister was subsequently postponed.

Despite those tensions and some anti-Japanese backlash in China, the size of the world’s second-largest economy means that many companies see it as an essential market which cannot be abandoned.

Furniture retailer Nitori Holdings Co. is increasing its presence in mainland China, having opened its first store in Beijing late last year. Fast Retailing Co.’s Uniqlo and Ryohin Keikaku Co’.s Muji both have a substantial presence in China as well.

Murata Manufacturing Co., which is a key supplier for Apple Inc., is running a long-term project to build a production chain that operates completely in China using local parts.

That company announced a 45 billion yen investment in China late last year to make capacitors for electric vehicles and smartphones. However, it’s also investing more in Vietnam and elsewhere, with President Norio Nakajima saying late last year that China and the US are decoupling faster than expected.

–With assistance from Takashi Mochizuki.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.