(Bloomberg) — Federal Reserve officials meeting later this month are expected to look more kindly on another stepdown in their aggressive campaign of interest-rate increases after wage growth cooled in December.

(Bloomberg) — Federal Reserve officials meeting later this month are expected to look more kindly on another stepdown in their aggressive campaign of interest-rate increases after wage growth cooled in December.

US average hourly earnings rose 0.3% in December from a month earlier and 4.6% from December 2021 — both less than expected — after a downward revision to November. But job growth remained solid and the unemployment rate declined to 3.5% from 3.6%.

Treasury yields fell after the wage figures and plummeted further following data showing service industries were unexpectedly weak last month. Traders trimmed expectations for just how high the Fed might push its benchmark, while also shifting bets more toward a quarter-point hike rather than a half point at the next meeting, which takes place Jan. 31 and Feb. 1.

“They’re certainly going to continue to raise rates at the end of this month — likely continue to do that in March,” former Fed Governor Randall Kroszner told Bloomberg Surveillance. “But it may make it more likely that they go 25 basis points rather than 50 basis points at these meetings, I think that’s really where it’s going to be.”

Atlanta Fed President Raphael Bostic said Friday that the central bank still needs to keep raising interest rates despite cooler-than-expected wage data and indicated he’s open to either a quarter-point or half-point move.

“They’re certainly going to continue to buy insurance” against the risk that inflation will remain sticky amid a tight labor market, said Kroszner, an economics professor at the University of Chicago Booth School of Business, who called the data an “ immaculate disinflation report” because both wage growth and the unemployment rate declined.

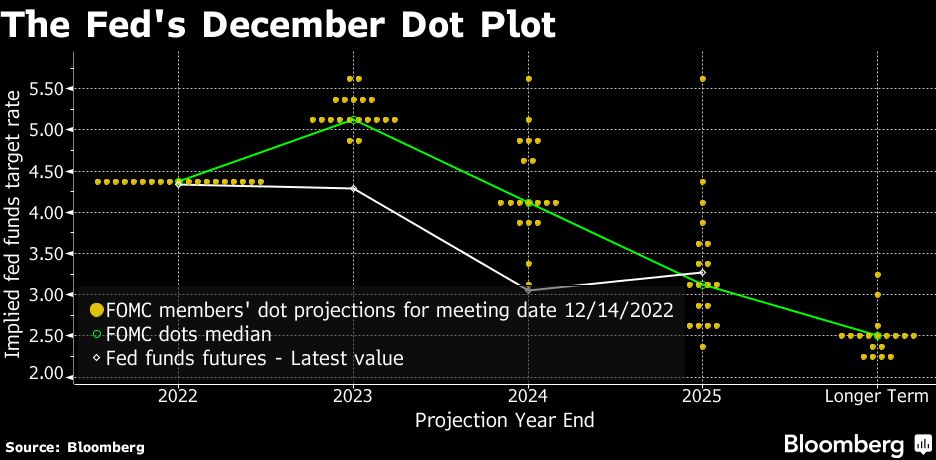

Fed officials raised rates by 50 basis points in December, moderating their pace of increases after four straight 75 basis-point moves, while signaling they expect to keep hiking in 2023.

The increase lifted their benchmark to 4.3% and officials projected rates peaking at 5.1%, according to their median forecast. Investors see about 30 basis points of tightening at the Fed’s next meeting, according to pricing in futures markets.

What Bloomberg Economics Says…

“Momentum in the labor market may have picked up again after loosening somewhat toward the end of last year. Together with what we know about early revisions to benchmark data, that leads us to expect two more 25-basis-point rate hikes by the Fed, with the terminal rate reaching 5% in March.”

— By Anna Wong and Eliza Winger (economists)

— To read more click here

Officials, who will receive December’s consumer price report next week, have made clear they expect to hold interest rates high for some time and the dovish signal from cooler wage growth was not expected to shift that outlook.

“In terms of Fed policy, while job growth remains solid and the unemployment rate is low, a deceleration in wages in December and the downward revision to November will be welcome news and could support another stepdown to a 25 basis-point hike in February,” Rubeela Farooqi, the chief US economist at High Frequency Economics, said in a note.

(Updates with detail on market reaction, additional data)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.