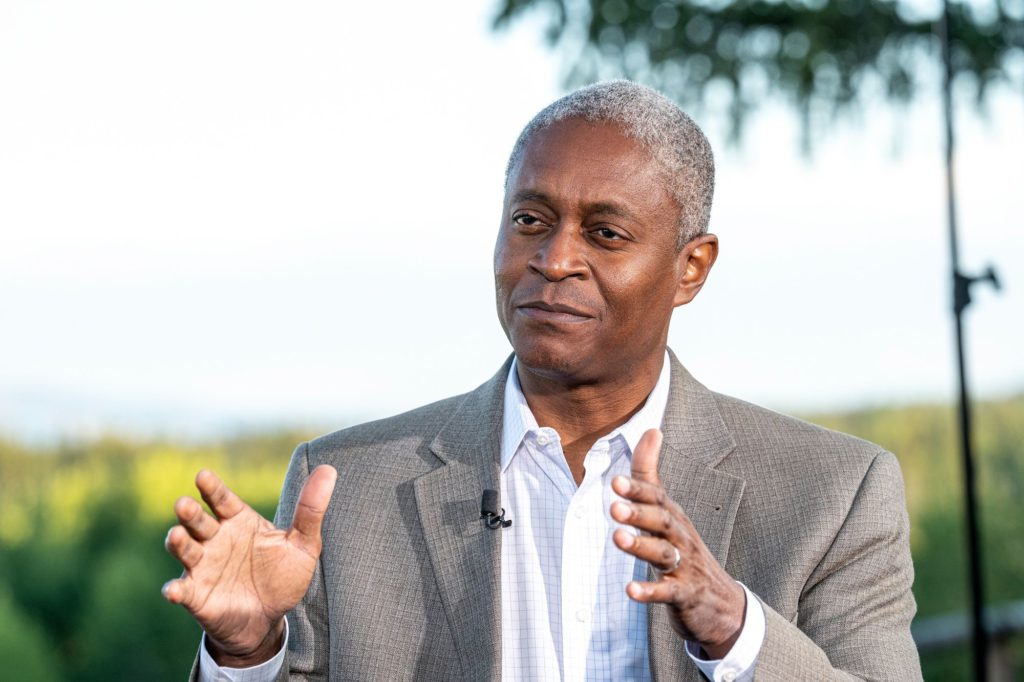

(Bloomberg) — Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank still needs to keep raising interest rates despite cooler-than-expected wage data and indicated he’s open to a second straight half-point increase.

(Bloomberg) — Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank still needs to keep raising interest rates despite cooler-than-expected wage data and indicated he’s open to a second straight half-point increase.

“Today, I’d be comfortable with either a 50 or a 25, and if I start to hear signs that the labor market is starting to ease a bit in terms of its tightness, then I might lean more in the 25 basis-point position,” Bostic said Friday during an interview with CNBC. His peak rate projection of 5% to 5.25% is “the range I think we need to move to if the economy proceeds as I expect which is continual gradual slowdown.”

Bostic is not a voter on the Fed’s rate-setting panel this year.

Fed officials raised interest rates by a half-point in December, extending their aggressive tightening campaign and bringing the target on their benchmark rate to a range of 4.25% to 4.5%. The move followed four larger hikes of 75 basis points to curb inflation running well above their 2% target.

Policymakers say their next rate move will be determined by economic data, including inflation and employment reports. Officials will meet next on Jan. 31 and Feb. 1.

Labor Department data released Friday showed that the US economy added 223,000 jobs in December and the unemployment rate dropped to 3.5%. At the same time, wage growth slowed, which supports the odds for a soft landing, where the Fed manages to cool inflation while minimizing pain in the labor market.

US average hourly earnings rose 0.3% in December from a month earlier and 4.6% from December 2021 — both less than expected — after a downward revision to November.

Still, Bostic told a panel during the American Economic Association’s annual meeting in New Orleans later on Friday that “it is going to take some time for us before inflationary pressures return to historical levels.”

He said that recent signals on price pressures have been “moving in a positive direction” but it was premature to declare that inflation has peaked.

“It is really important that we as the Fed are clear and consistent in our policy posture,” Bostic said, adding that he favors maintaining rates once they reach a peak well into 2024.

“We’re not going to be bouncing policy back and forth. We’re really going to let the restrictiveness hold,” he said.

(Updates with Bostic’s later remarks on AEA panel in last three paragraphs)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.