European tech companies that work with the defense industry, long an investment taboo for many venture capital firms, are drawing record amounts of funding in the wake of Russia’s invasion of Ukraine.

(Bloomberg) — European tech companies that work with the defense industry, long an investment taboo for many venture capital firms, are drawing record amounts of funding in the wake of Russia’s invasion of Ukraine.

In the past year, governments across the continent have ramped up spending on military defense, pledging billions of euros to modernize and build their militaries. Private investment in defense-related tech companies has increased in tandem. According to startup data provider Pitchbook, investment in aerospace and defense last year reached an all-time high of almost €780 million.

This marks a major shift. “It’s just not an option to not have the discussion,” said Uwe Horstmann, a general partner of Project A, which invests in defense tech companies. “Because it’s so clear that the situation has completely changed.”

In peacetime Europe, investing in defense could be controversial. In late 2021, an investment firm run by Spotify founder Daniel Ek put €102.5 million ($109 million) into Helsing.AI — an artificial intelligence company that provides battlefield data analytics. News of the investment prompted calls to boycott Spotify, and complaints that the music streaming service was supporting military endeavors.

Such moves are now far more common. Technologies that can have both military and commercial applications — typically classified as “dual-use” — have attracted new investor interest since the invasion of Ukraine. In October, Project A, Sanno Capital and billionaire Peter Thiel invested $17.5 million in Quantum-Systems GmbH, a drone company that develops docking stations which allow unmanned aerial vehicles to be charged and deployed without human operators. The devices are designed for use by the military, border patrol agents, mining companies and to conduct surveillance in cities.

In 2022, Quantum-Systems supplied 42 drones through the German armed forces to support the Ukrainian army.

Read More: Peter Thiel Backs German Startup Delivering Drones to Ukraine

Partly as a result of the war, European defense startups have dodged the broader slump in technology investment. As interest rates and inflation rose at the start of 2022, the wellspring of venture capital money that flowed during the pandemic dried up for many startups. Aerospace and defense tech were notable exceptions, and the sectors have continued to secure investment in spite of the downturn.

According to Gundbert Scherf, co-founder of Helsing.AI, this is likely to continue as more investors and engineers in Europe rethink their priorities in the face of Russian aggression.

“Ukraine has probably shown that democracies need to be technology makers and not technology takers,” said Scherf, who was previously a senior adviser to the German Defense Ministry. “People are increasingly interested in contributing to a larger mission.”

Changing European government policies are also encouraging investors to make bets on defense tech. While Ek was something of an outlier among European tech investors when he launched Prima Materia in 2020 to cultivate the continent’s homegrown critical technologies, the investor landscape has changed significantly since the invasion.

“There’s a lot of interest now, including from European VCs,” said Helsing.AI co-founder Thorsten Reil.

Following Ek’s investment, Helsing.AI announced partnerships with Saab AB and Rheinmetall AG to develop its capacities in electronic warfare and land defense.

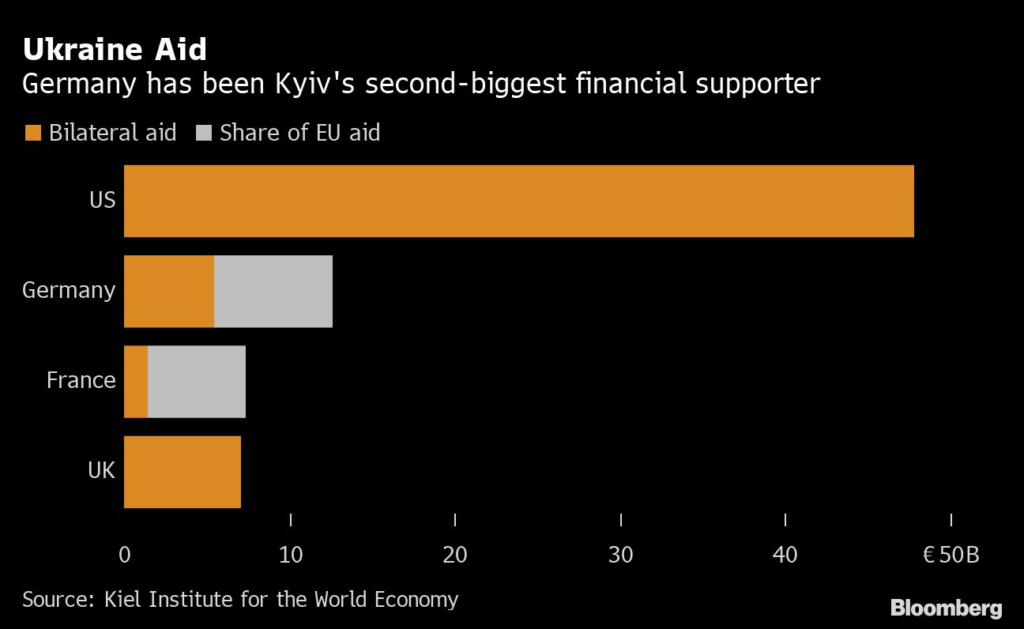

European nations have boosted their defense budgets since the war began. Germany, which limited spending on its armed forces for decades, announced new commitments to defense funding and earmarked €10 billion ($10.6 billion) to buy 35 F-35A Lightning II fighter jets. In April, shortly after the invasion, NATO launched its Defense Innovation Accelerator, a program designed to invest €1 billion in early-stage startups and other deep tech funds aligned with the bloc’s strategic objectives.

Last year, the European Union’s Defense Fund also awarded €1.2 billion to 61 defense research and development projects.

Daniel Metzler, the CEO of Isar Aerospace, which develops rockets for satellites that can also be used for defense purposes, says the war in Europe has transformed how some employees think about the sector. “They want to help maintain a peaceful existence on our planet,” Metzler said, “They shy less away, in my opinion, from working on dual-use technologies. Perhaps some three or four years ago, they would’ve never considered working in a field like that.”

The German rocket-maker has also seen growing interest in dual-use technologies from investors since the war broke out. “Just two years ago everyone said, No, we won’t touch any defense-related technology because some of their limited partners and investors said they weren’t allowed to do military technology,” Metzler said. “That is really changing from both the investor and the LP side.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.