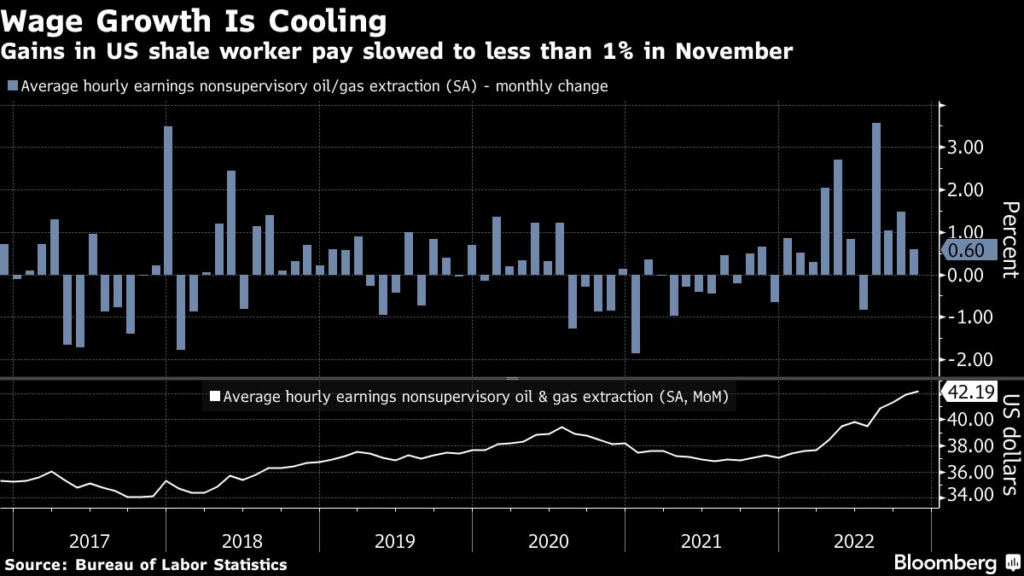

(Bloomberg) — Monthly wage growth in the US shale patch slowed to less than 1% in November as explorers pulled back activity in an effort to manage record costs in the oilfield.

(Bloomberg) — Monthly wage growth in the US shale patch slowed to less than 1% in November as explorers pulled back activity in an effort to manage record costs in the oilfield.

Average hourly earnings in oil and gas extraction for nonsupervisory workers were up 0.6% in November from the previous month to $42.19, according to Bureau of Labor Statistics data released Friday. Compared with a year ago, the 13% growth matches last month’s annual change.

Labor shortages in the oilfield have been one of the biggest hurdles holding back production growth. The overall number of workers employed in US oil and gas jobs totaled 136,100 in December, down 3.1% from last year’s peak in July. Near the start of 2022, oil workers showed a willingness to leave the industry for higher pay elsewhere. But record profits throughout the year allowed oil companies to boost compensation in order to lure more workers back.

The jobless rate in oil and natural gas fell to 1.9% in December from 3.1% in the prior month on an unadjusted basis, government figures show. That compares with an unemployment rate of 5.8% a year ago.

The slowdown in oilfield earnings growth fits the overall trend seen across the US economy last month, indicating a resilient labor market that may allow the Federal Reserve to further slow interest rate hikes.

Shale drillers typically reduce drilling during the final weeks of the year as annual budget outlays are exhausted. Oilfield inflation was as much as 25% last year, according to estimates by JPMorgan Chase & Co., causing some explorers to slow activity as costs ate into budgets.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.