(Bloomberg) — Hopes the Federal Reserve can tame inflation without widespread job losses mounted Friday after a government report showed robust hiring and a historically low unemployment rate paired with a cooling in wage growth.

(Bloomberg) — Hopes the Federal Reserve can tame inflation without widespread job losses mounted Friday after a government report showed robust hiring and a historically low unemployment rate paired with a cooling in wage growth.

In some respects, the December jobs report offered a best-case scenario for the Fed — Americans keep their jobs but inflationary pressures of earnings are easing — giving policymakers room to slow the pace of interest-rate hikes.

Most economists anticipate the Fed’s aggressive tightening to push the economy into recession in the next year and for unemployment to rise to some degree. Last month’s trends, if sustained for several months, mitigate the chances of an economic downturn — at least for now.

“It’s not that the Fed wants fewer jobs. What they want is lower wage growth, more because they’re worried about persistent inflation,” Randall Kroszner, a former Fed governor and now an economics professor at the University of Chicago Booth School of Business, said on Bloomberg Television.

Fed officials raised interest rates by 50 basis points in December, bringing them to the highest level since 2007. They moderated their pace after four straight 75 basis-point moves, but signaled they not only expect to keep hiking in 2023 but also to keep rates elevated for some time.

The data “may make it more likely that they go 25 basis points rather than 50 basis points” at the February and March meetings, Kroszner said.

Key takeaways from the December jobs report:

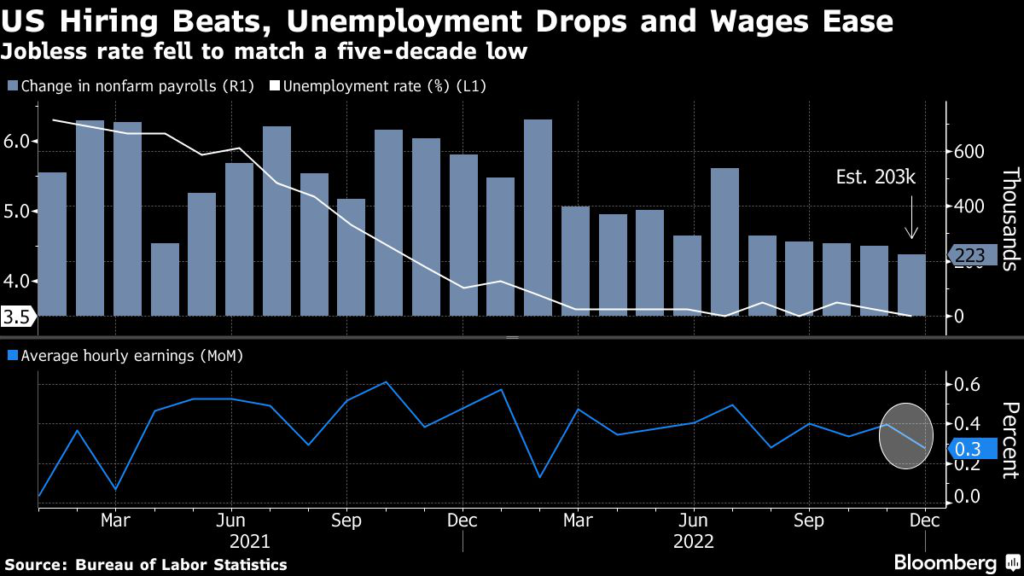

- Nonfarm payrolls increased 223,000 in December, capping a near-record year for job growth and topping the median forecast in a Bloomberg survey of economists

- The unemployment rate fell by 0.1 percentage point to 3.5%, matching a five-decade low, as participation inched higher

- Average hourly earnings rose 0.3% from a month earlier, a slower increase than forecast after a downward revision the prior month

Read More: US Hiring Solid While Wages Cool, Giving Fed Room to Slow Hikes

The S&P 500 rose and Treasuries rallied as investors speculated the easing in wage pressures would lead the Fed to pursue less restrictive policy in the coming months.

One set of data won’t sway policymakers, though, and Fed Chair Jerome Powell has emphasized the need to see a sustained downward trend in inflation. The highly watched consumer price index for December is due next week.

Separate figures out Friday showed a gauge of activity in the services industry contracted in December for the first time since May 2020. The Institute for Supply Management’s measure of services employment shrank for the second time in three months, with respondents noting both trouble filling positions and hiring restraint tied to economic concerns.

‘Goldilocks Print’

Last month’s job gains were led by health care and social assistance, leisure and hospitality, and construction. Several sectors were little changed.

The figures underscore both the enduring strength of the jobs market and and a persistent imbalance in labor supply and demand. But an uptick in participation paired with the slowdown in wage growth suggest some of the tightness in the labor market is starting to unwind.

What Bloomberg Economics Says…

“December’s nonfarm-payroll report seems like a Goldilocks print: An expanding labor force and robust hiring drove down the unemployment rate, but wage growth also moderated… momentum in the labor market may have picked up again after loosening somewhat toward the end of last year.”

—Anna Wong and Eliza Winger, economists

To read the full note, click here

Read More: Fed Seen Leaning Toward Smaller Hikes After Wage Growth Cools

The report was “full of good news” for the possibility of a soft landing — a scenario where the economy cools without contracting — according to Nick Bunker, head of economic research at Indeed Hiring Lab.

“If these trends continue, we can feel more and more confident that the strength of this labor market is sustainable,” he said in a note. “The outlook for next year is uncertain, but many signs point toward a soft landing.”

Still, there are growing pockets of weakness in the labor market, particularly in sectors like technology and real estate. Non-durable goods manufacturing, temporary-help services and information all shed workers in December, the Labor Department report showed.

The concentrated nature of payroll gains paired with the fewest hours worked since the onset of the pandemic tempered some optimism around labor demand.

Just this week, Amazon.com Inc. said it plans to cut more than 18,000 employees — the biggest reduction in its history — while the real estate brokerage Compass Inc. announced further layoffs.

The labor force participation rate — the share of the population that is working or looking for work — ticked up to 62.3%, and the rate for workers ages 25-54 rose.

–With assistance from Molly Smith and Vince Golle.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.