(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Only a slowdown in core inflation can alter the European Central Bank’s resolve to raise interest rates, according to Governing Council member Robert Holzmann.

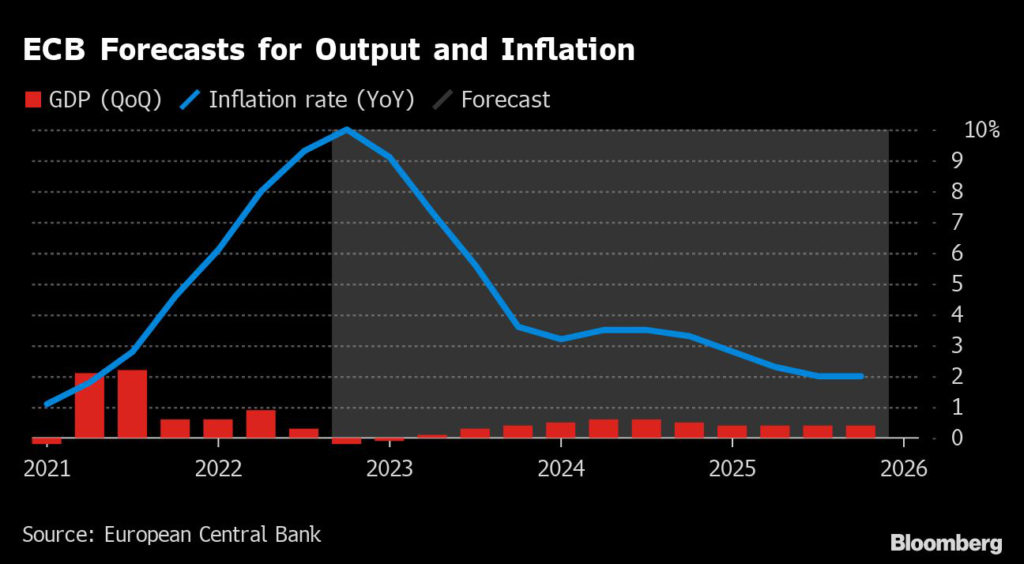

While there’s hope that headline consumer-price gains have peaked, that’s not the case for underlying inflation, Holzmann said Wednesday. Officials must watch the latter very closely, he said.

“As long as core inflation isn’t peaking, the change in headline inflation won’t make a change in our determination,” the hawkish Austrian central bank chief said in Vienna.

Holzmann’s comments chime with the tough tone of Executive Board member Isabel Schnabel, who said Tuesday that rates must still rise significantly — even after euro-zone inflation dipped back into single digits for the first time since last August. Underlying price growth advanced to a record last month as the spike in energy costs continues to feed through to goods and services.

Europe’s economic backdrop has become more conducive to further hikes, with unusually warm weather bringing down natural gas prices, offering households some relief. Goldman Sachs boosted its growth outlook this week and no longer sees a recession.

Where the ECB’s deposit rate, currently 2%, eventually ends up remains a key question. Bank of France Governor Francois Villeroy de Galhau reiterated Tuesday that the peak should be reached by the summer, declining to speculate on how high rates will go.

Due to the high uncertainty, it’s too early to discuss the so-called terminal rate, according to Holzmann, though he concurred with Villeroy’s timeline.

“Whether it will be done by another four times 50 basis points or not, it will be shown,” he said. “But quite definitely we’re there to act quickly, in time and in a determined manner.”

–With assistance from William Horobin.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.