Kazakhstan said local brokerages that snapped up Russian sovereign debt last year did so largely on behalf of clients who were Kazakh and Russian residents.

(Bloomberg) — Kazakhstan said local brokerages that snapped up Russian sovereign debt last year did so largely on behalf of clients who were Kazakh and Russian residents.

Disclosing details of a bond-market maneuver used by some investors in navigating sanctions against the Kremlin, Kazakhstan’s Agency for Regulation and Development of Financial Market said transactions with ruble government securities, known as OFZ, generated deals worth a total of 641.1 billion tenge ($1.4 billion) since March. It didn’t give earlier figures for comparison.

Among brokerages that used customer funds in the transactions — which made up about half of the total — Kazakh clients accounted for 48.7% of the purchases in the period to Dec. 1, while the share of Russians was 41.4%. The agency also said that other buyers included residents of the United Arab Emirates and Slovakia.

Bloomberg News reported last month that Kazakh financial firms were buying Russian government debt at a steep discount. Registering the debt with a Kazakh clearing house then enables buyers to collect coupon and principal payments.

Kazakhstan’s Central Securities Depository previously said it saw a 100-fold increase in eight months in the volume of registered eurobonds and OFZ debt issued by the Russian Finance Ministry.

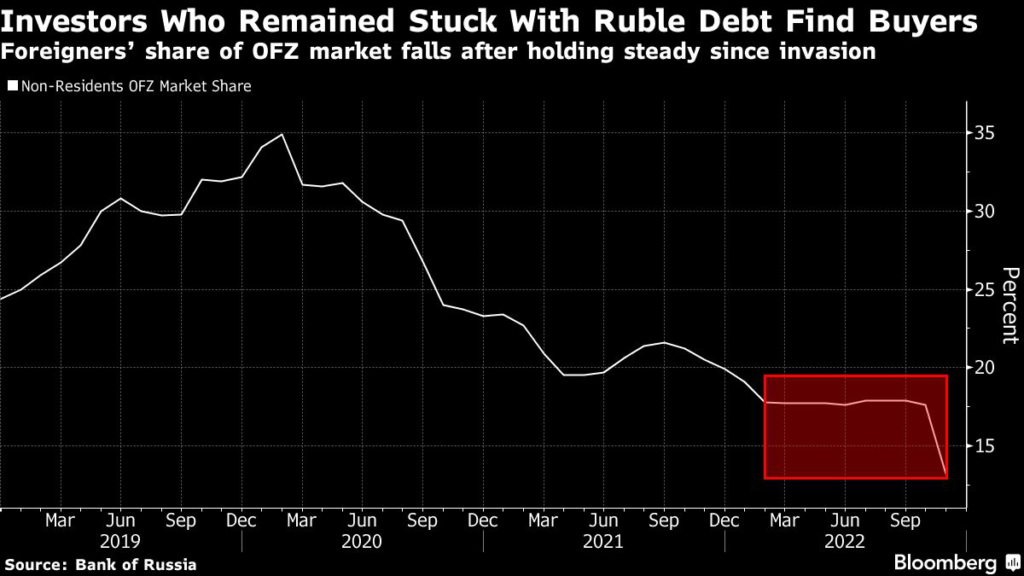

The volumes highlight the increasing reliance of some investors on a financial backdoor provided by Kazakhstan after sanctions and other restrictions imposed after the invasion of Ukraine left many foreigners unable to divest holdings in Russian debt.

In Russia, OFZ securities due in 10 years have recovered close to face value, according to data from the Moscow exchange, indicating investors don’t expect to suffer losses. Back in August, when Bloomberg News reported that firms including Barclays Plc were facilitating an uptick in trading of the debt, the financial institutions were offering bids in the region of 20-25 kopecks on the ruble.

An index of Russian government bonds dropped about 4% last year, recouping losses that were in double digits in the months after the war began in late February.

Surviving Sanctions

The emergence of Russians among the biggest buyers via Kazakh brokerages also underscores the ability of investors there to move capital out of the country and seize on opportunities presented by cracks in the sanctions regime. In the third quarter, foreign-currency deposits of Russian households in overseas banks surged the most in at least four years.

Some investors have found a workaround in Kazakhstan because the Central Asian country maintains its financial and trade links with Russia while steering clear of backing the war or recognizing the annexation of Ukrainian territories.

The Kazakh regulator said six Kazakh brokerages, which it didn’t name, were involved in trading Russian debt, using both their own money and customer funds.

In compliance with anti-money laundering laws, brokerages take into account the existing system of sanctions as they scrutinize all potential customers when opening and using their accounts, it said.

The regulator warned that investing in OFZ bonds carries increased risks because of the “high level of volatility in securities markets, low liquidity, and the threat of secondary sanctions related to the geopolitical situation.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.