Euro-zone banks are returning another €62.8 billion in cheap long-term funding to the European Central Bank, significantly less than at previous opportunities that follow a toughening of the program’s conditions.

(Bloomberg) — Euro-zone banks are returning another €62.8 billion in cheap long-term funding to the European Central Bank, significantly less than at previous opportunities that follow a toughening of the program’s conditions.

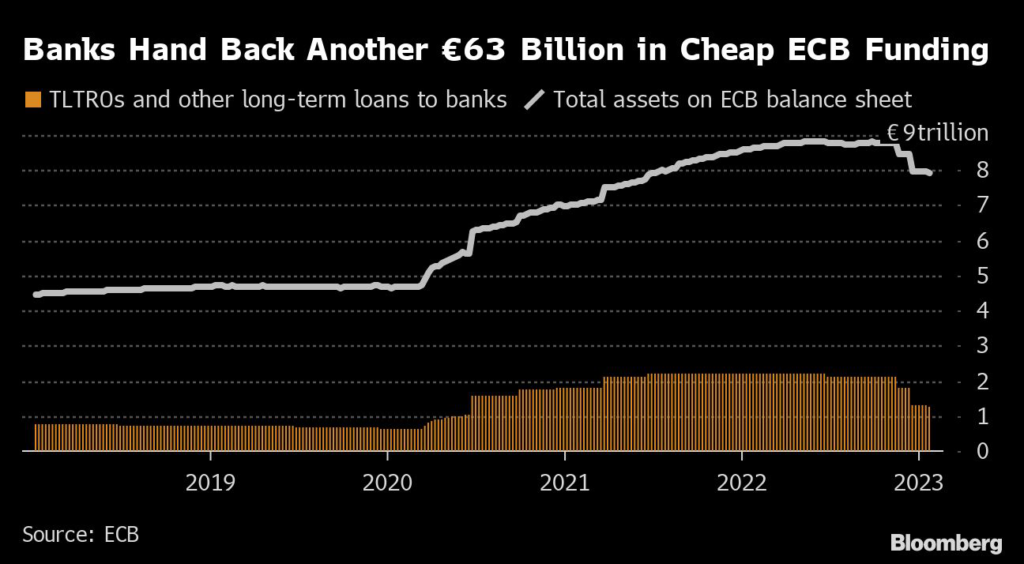

The repayment will further shrink the outstanding amount of the so-called TLTRO loans — currently about €1.3 trillion — and comes after banks already handed back almost €800 billion in November and December.

Economists polled by Bloomberg had estimated that €213 billion would be repaid this month. The outcome was below even the smallest prediction.

The TLTRO loans were offered at attractive terms during the pandemic to keep credit flowing to businesses and households. In October, ECB officials decided to impose stricter terms, arguing the step was necessary to bring the program in line with its fight against surging consumer prices.

The ECB raised borrowing costs by 250 basis points last year, the most aggressive tightening push in its history. Chief Economist Philip Lane has touted the TLTRO repayments as key to reducing the central bank’s balance sheet, which ballooned in recent years when inflation was low.

Before Friday’s release, economists at Barclays argued that repayments in this month’s round would be small because, unlike in the year-end runup, there’s no regulatory incentive for banks to hand back the money. The uncertain economic outlook may also lead them to keep higher liquidity buffers, Ludovico Sapio and Paola Sabbione said in a report to clients.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.