The Bank of Japan pushed back against intense market speculation of policy change by ramping up the defense of its stimulus framework, prompting sharp slides in the yen and bond yields.

(Bloomberg) — The Bank of Japan pushed back against intense market speculation of policy change by ramping up the defense of its stimulus framework, prompting sharp slides in the yen and bond yields.

Governor Haruhiko Kuroda’s board kept its main policy settings unchanged Wednesday, leaving its negative interest rate at -0.1% and the target for 10-year yields under its curve-control program around 0%.

The central bank said it would continue large-scale bond buying and increase purchases on a flexible basis if needed as it showed its intention to commit to its yield curve control program for now.

It also enhanced its loan provision to commercial banks in a bid to encourage them to buy more debt — another tactic in its stubborn defense of policy.

The BOJ’s updated forecasts also showed that officials still don’t see inflation staying above 2% in a sustainable manner over the coming years, offering a justification for continued stimulus even after Kuroda steps down in April.

The earlier-than-expected release of the statement pointed to consensus on the BOJ board despite the strength of market bets that it must be close to buckling on a policy stance that is out of sync with major peers including the Federal Reserve, the European Central Bank and the Bank of England.

The yen tumbled more than 2% to 131.58 per dollar after the decision, while benchmark 10-year yields sank over 10 basis points to below 0.4% when they reopened from the lunch break.

Stocks jumped more than 2%.

“This means there’s a higher chance the BOJ will pass the current policy framework on to the next leadership rather than changing it under Kuroda,” said Hideo Kumano, executive economist at Dai-Ichi Life Research Institute.

“March is a period for corporate earnings and the BOJ wouldn’t want to rock the boat and cause confusion then.”

The governor reiterated his view that the stimulus framework is not under threat at a press briefing after the decision ahead of his trip to the World Economic Forum in Davos, Switzerland.

“I believe that the bond market’s functioning will improve going forward and in that sense I think yield curve control is entirely sustainable,” he said.

Kuroda also said a further widening of the band around the BOJ’s yield target was not needed.

He indicated he wouldn’t rule out paying banks to borrow money via the loan provision program.

Speculation that the BOJ would take clearer steps toward a normalization of policy intensified after it unexpectedly widened its 10-year yield target band last month, a move that three-quarters of polled economists interpreted as a step toward a normalization of policy.

Since then Kuroda’s massive easing program has come under the fiercest market attacks of his decade-long term.

While Kuroda insisted that last month’s move aimed to improve market functioning, it only fueled speculation over more changes and ramped up attacks on the the new yield cap of 0.5%.

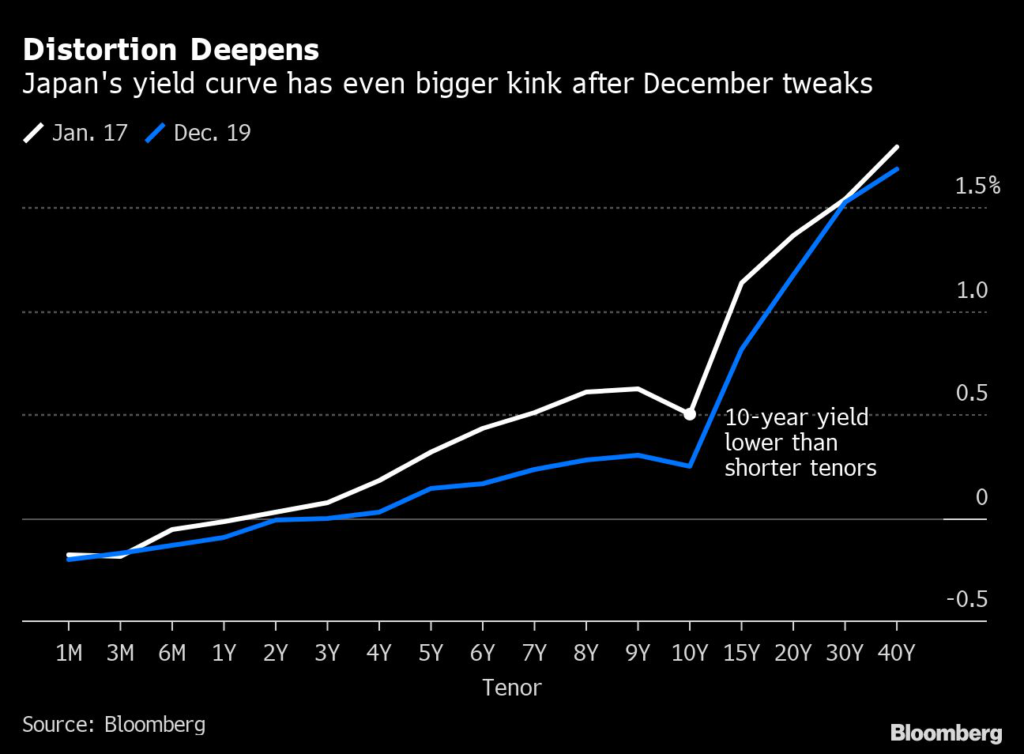

December’s doubling of the yield ceiling has done little to improve liquidity and a distortion in the yield curve flagged by Kuroda has deepened since then. Some believe there will be more action even before the governor’s term ends.

“Last month’s surprise move meant that the BOJ likely had to look at its impact for now,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence.

“The yield curve hasn’t quite moved in the way the BOJ probably wanted, but if the BOJ moved again now it would certainly look like it was responding to market pressure, making it ultimately more difficult to sustain yield curve control.”

In the runup to the gathering, speculation heated up as 10-year yields repeatedly breached its new ceiling of 0.5%.

The central bank bought around 3 trillion yen ($23 billion) of government bonds over Monday and Tuesday in addition to almost 10 trillion yen defending its stimulus framework on the final two days of last week.

What Bloomberg Economics Says…

“Our baseline view is that the BOJ won’t reduce stimulus until Japan achieves a recovery with sustainable wage growth, conditions that probably won’t be met until 1Q24.

In the short-term, the BOJ will likely resort to more jawboning and operational tactics to counter upward pressure on yields.”

— Yuki Masujima, economist

For the full report, click here

With a new governor soon to take the helm of the bank, the speculation of change is likely to keep smoldering on, with speculators waiting for their moment to make another attack on the framework.

“A lot of commentators argue BOJ YCC is on borrowed time,” said Richard Franulovich, head of FX strategy at Westpac Banking Corp.

in Sydney. “The next BOJ meeting isn’t until March 9, so you’re asking a lot of markets to pivot back into expectations for a BOJ policy tweak in seven weeks time.”

Why BOJ’s Small Tweak to Bond Yields Was a Bombshell: QuickTake

As a way of shoring up its defense, the bank said Wednesday that it would decide on the interest rate for certain loans to commercial banks.

Until now, these loans have essentially offered free money to banks for up to 10 years that they can use to buy bonds, thereby helping the BOJ keep yields down.

Banks took up funds worth 4 trillion yen on Thursday and Friday last week.

After Wednesday’s enhancement, the BOJ will be able to set specific interest rates for each loan provision operation, enabling the bank to better target specific maturities along the yield curve.

“I won’t rule out the possibility of negative rates being applied to the fund supply operations, but either way we’ll operate flexibly within the enhanced perimeters,” Kuroda said, hinting at a potentially more aggressive use of this tool.

The enhancement is a powerful change, according to Masamichi Adachi, chief Japan economist at UBS Securities and a former BOJ official.

“This will help enable the BOJ to lend funds in a way that creates the yield curve they want.”

BOJ Has High Risk of Below-Target Inflation, IMF’s Gopinath Says

With the BOJ’s price forecasts still showing a cooling of inflation over the coming months and below target price growth after that, the central bank has some justification for continuing with stimulus even after Kuroda’s term.

Speaking at Davos, Gita Gopinath, first deputy managing director of the International Monetary Fund, told Bloomberg that she also sees a risk of Japan’s inflation falling back well below 2%.

“They have to do this complex trade off of keeping monetary policy accommodative while ensuring that it’s consistent with the inflation data coming up,” Gopinath said.

Still, with the memory of December’s shock move still vivid in the mind of global investors, bets on further BOJ shifts are unlikely to go away, with bonds and the yen among the markets most at risk.

The yen could weaken to the 135 per dollar level if the BOJ continues to maintain its monetary policy setting into the next meeting, according to SAV Markets.

“There are some good levels at around 134, 135 for investors to take dollar-yen to,” said Shyam Devani, macro trader at SAV Markets in Singapore.

“This story is not over yet — investors will continue looking to test the BOJ.”

–With assistance from Ruth Carson, Yoshiaki Nohara and Erica Yokoyama.

(Updates with comments from Governor Kuroda)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.