India’s bid to streamline bankruptcy proceedings includes provisions that could change the proportion of money creditors get from a firm’s liquidation.

(Bloomberg) — India’s bid to streamline bankruptcy proceedings includes provisions that could change the proportion of money creditors get from a firm’s liquidation.

To speed up proceedings and counter a mounting caseload, the Ministry of Corporate Affairs last week published published dozens of proposed amendments to the insolvency code, giving the public until Feb. 7 to provide input. Any changes to the law would have to be voted on by parliament.

Provisions under consideration include the introduction of a new electronic case management system, penalties for frivolous claims, and changes to the way secured and unsecured creditors can be treated when a company’s remaining assets get sold.

“These amendments, if it goes through, would go a long way in smoothening the process, reduce timelines and thereby improving the recoverability,” said Prakash Agarwal, director and head of financial institutions, India Ratings and Research. “Given the limited clarity on the distribution of proceeds, there was lot of litigation taking place.”

The Insolvency and Bankruptcy Code of 2016 helped Indian banks shed bad loans in the run-up to the pandemic, by imposing a deadline for resolving distressed cases and a provision permitting the sale of companies through a bidding process.

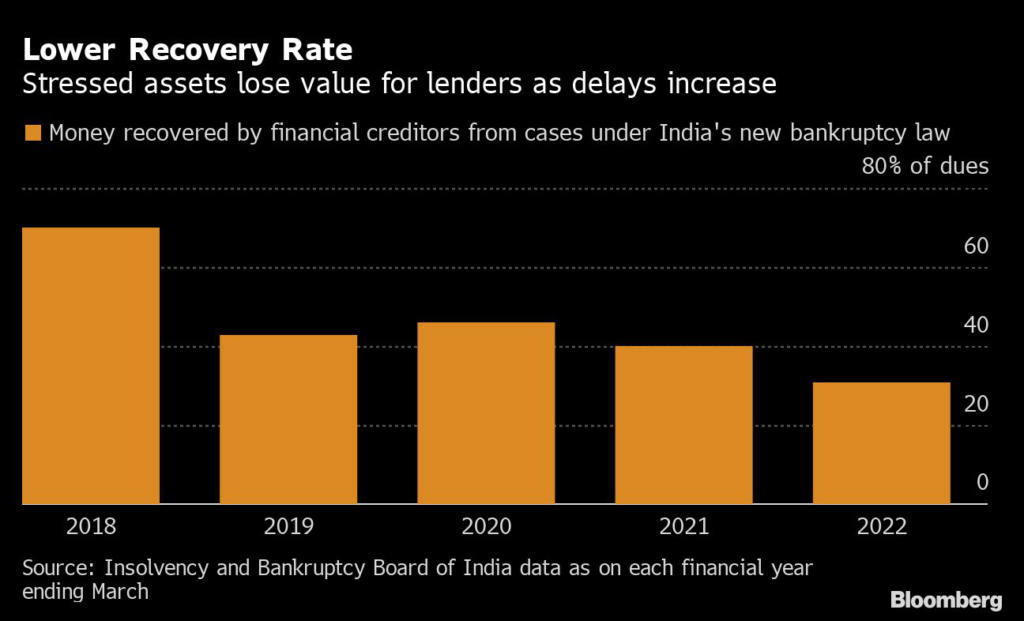

But despite efforts to speed up proceedings, the case load has mounted due to missed deadlines, more filings and even a lack of judges. The time to initiate and resolve bankruptcies increased, and investors are recovering an ever smaller share of their funds, according to official statistics.

Under the proposed new system, creditors will receive money totaling as much as the liquidation value of the company, and if there are any additional funds they will be distributed among all creditors in relation to their unsatisfied claims, and finally to shareholders, said Sonam Chandwani, Managing Partner at KS Legal & Associates.

“Creditors will positively be impacted as a roadmap of prioritisation in re-payment will aid in promoting their interests,” she said.

The average recovery rate on assets plummeted to around 30% in March 2022 from around 70% in 2017. It stood at about 33% in September, according to Insolvency and Bankruptcy Board of India data.

“At least it’s clear that the government is alive to the problems and all issues are being considered,” said L. Viswanathan, partner at the law firm Cyril Amarchand Mangaldas.

–With assistance from Vrishti Beniwal, Shruti Mahajan and Preeti Singh.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.