Hungary’s central bank is poised to keep its benchmark facility unchanged as investors raise bets for a more rapid unwinding of the European Union’s highest interest rates.

(Bloomberg) — Hungary’s central bank is poised to keep its benchmark facility unchanged as investors raise bets for a more rapid unwinding of the European Union’s highest interest rates.

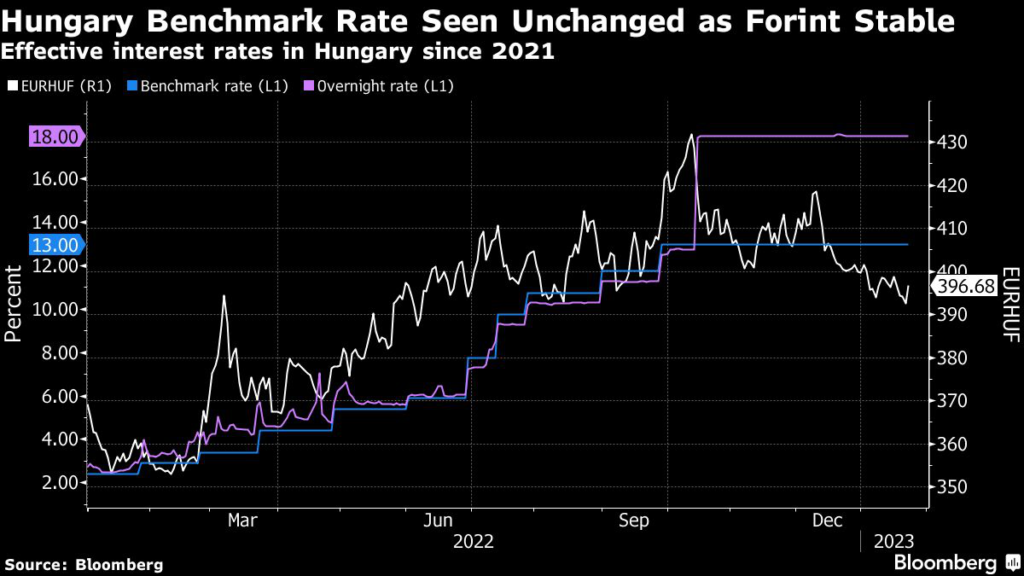

Policy makers will keep the base interest rate at 13% on Tuesday, according to all economists in a Bloomberg survey. Investors are looking past that instrument, however, to the key one-day deposit rate.

Established in October via an emergency central bank intervention to arrest the plunge of the forint, that rate is now at 18%. The question dominating investors’ minds is when it will start to converge with the base rate, with eyes on a statement and likely briefing at 3 p.m. in Budapest for any hints on a pivot toward easing.

Rate-setters have sought to dampen expectations of a quick reversal, citing the EU’s fastest inflation at close to 25%, as well as an effective freeze on about $30 billion of EU funding for Hungary over rule of law concerns. Fitch Ratings last week cut the outlook on Hungary’s sovereign rating — now at the second-lowest investment grade — to negative from stable.

Despite the risks, the forint rallied last week to near its strongest level against the euro in seven months, boosting bets for monetary easing. Traders now see almost 40 basis points in cuts within a month and close to 200 basis points in three months, according to forward rate agreements, which is more than a month ago.

Beyond the post-decision statement, any signal of a pivot toward more relaxed monetary policy may come at a central bank tender later this week, with the bank’s two-month deposit facility maturing on Jan. 26.

The facility holds the greatest volume of commercial banks’ free cash after the one-day deposits. The central bank has so far paid interest of 17.95%, close to the key interest level.

–With assistance from Veronika Gulyas.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.