The New York Stock Exchange is probing what caused wild price swings and trading halts when the market opened on Tuesday as shares for dozens of the biggest US companies suddenly plunged or spiked.

(Bloomberg) — The New York Stock Exchange is probing what caused wild price swings and trading halts when the market opened on Tuesday as shares for dozens of the biggest US companies suddenly plunged or spiked.

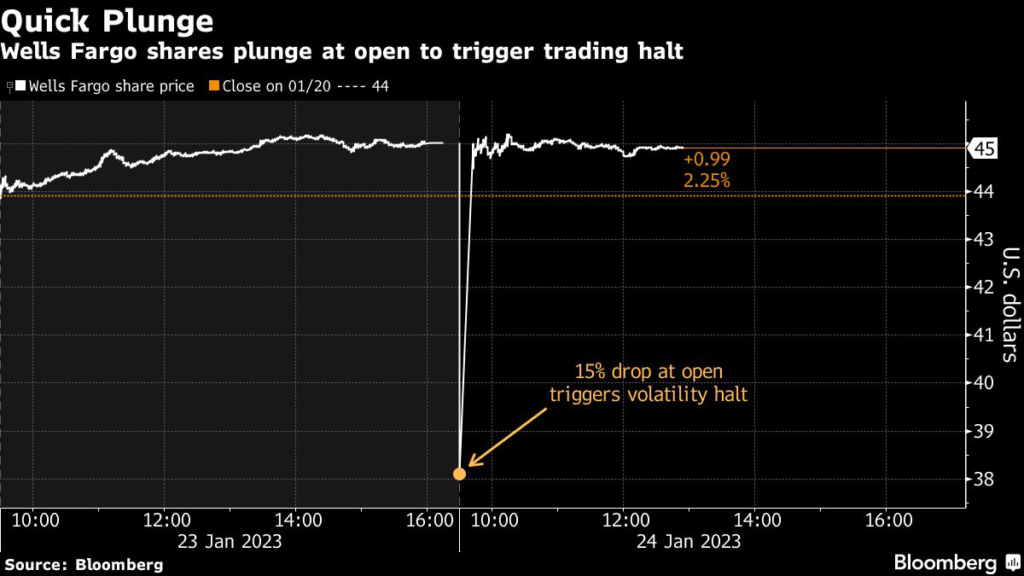

A “technical issue” that the exchange didn’t immediately identify resulted in some gyrations that spanned almost 25 percentage points between the high and low in a matter of minutes. Banks, retailers and industrial companies were among those affected, including Wells Fargo & Co., McDonald’s Corp., Walmart Inc. and Morgan Stanley.

The freakish action bears hallmarks of past episodes in which computer malfunctions led to sudden price distortions. While the probe was just getting started, the NYSE pointed to rules that could allow member firms affected by the swings to undo some of the damage.

“The exchange continues to investigate issues with today’s opening auction,” NYSE said on its website. “In a subset of symbols, opening auctions did not occur. The exchange is working to clarify the list of symbols.” The US Securities and Exchange Commission is also looking into the matter, according to an agency spokesperson.

At least 40 S&P 500 Index stocks were hit with trading halts, according to data compiled by Bloomberg. The distortions ripped through trading of Wells Fargo, which closed Monday at $45.03 and then fell as low as $38.10 before bouncing back. Morgan Stanley similarly plunged to $84.93 after ending at $97.13 on Monday, then made up almost all of the lost ground.

“It’s a little concerning; these are not your typical meme stocks, easily manipulated companies,” Oanda senior market analyst Ed Moya said by phone. “These are some of the giants.”

Walmart and McDonald’s were up and then down as much as 12% before reverting to more normal trading ranges. By midday in New York, the broad stock indexes were little changed.

Tuesday’s transactions occurred in New York Stock Exchange-listed securities and took place on other platforms, including ones overseen by Nasdaq Inc., CBOE Global Markets and private venues reporting to the Finra trade reporting facility.

Possible Relief

The amount of stock traded at away-from-market prices was just a tiny fraction of the usual volume in stocks that normally see millions of shares change hands each day. In companies like McDonald’s and Verizon Communications Inc., a few thousand shares went off at prices well above or below the last trade. Others like Nike Inc. and Exxon Mobil Corp. saw millions of dollars of stock move, data compiled by Bloomberg show.

Investors hurt by the moves might look to NYSE rules for some relief. In the event of a “system failure” occurring during the execution of a stock order, an organization can submit a claim and seek reimbursement for losses under Rule 18, the exchange states on its website.

Under the terms set by the exchange operator, a system failure is defined as “a malfunction of the NYSE’s physical equipment, devices, and programming that results in an incorrect execution of an order or no execution of an order that was received in NYSE systems.”

Help could also come from the “Clearly Erroneous Execution” rule, which lets organizations seek review on any order that is executed with “an obvious error in any term, such as price, number of shares or other unit of trading, or identification of the security.” The NYSE pointed out both rules in its statement Tuesday.

Previous Glitches

Episodes in which computer glitches lead to erratic pricing are rare on American exchanges but not unheard of. Perhaps the most famous was the August 2012 incident in which faulty software employed by one of the biggest market makers, Knight Trading, riddled exchanges with erroneous orders and sent shares swinging around the market.

The event sent Knight spiraling toward insolvency before it was bought out by a coalition of trading firms. Last year, Citigroup Inc.’s London trading desk was behind a flash crash that sent shares across Europe tumbling, while in Canada a software-issue caused a 40-minute outage across three stock exchanges.

Another mid-afternoon incident in May 2010 prompted Nasdaq OMX Group Inc. to cancel trades of 286 securities that fell or rose more than 60%.

Opening Auction

The start of trading in most American stocks involves a complicated but usually routine process called the opening auction, designed to limit volatility resulting from orders for shares that pile up before the start of the regular session. In it, a computer balances out supply and demand for a particular stock by establishing an opening price that can be viewed as the level that satisfies the largest possible number of traders.

“It was a bit of a scramble, said Justin Wiggs, managing director in equity trading at Stifel Nicolaus. “Overall, clients were surprisingly more reasonable and understanding than I expected,” Wiggs added. “They all seem to be willing to wait for NYSE to come back with their plan going forward. The message I’m hearing from NYSE is that it’s more or less on the individual broker to report anything they deem erroneous rather than doing a bulk halt/cancel/reset.”

At Meridian Equity Partners, “all of our phones are lighting up,” said Jonathan Corpina, senior managing partner who typically works on the floor of the NYSE. “We’re trying to field calls from our customers and try to explain to them what happened, what’s going on and relay as much accurate information so they understand what’s happening.”

–With assistance from Bailey Lipschultz, Jessica Menton and Lydia Beyoud.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.