The Bank of Canada led its peers into a succession of outsized interest-rate hikes last year and now may be the first to stop raising, although doing so presents a communications challenge for Governor Tiff Macklem.

(Bloomberg) — The Bank of Canada led its peers into a succession of outsized interest-rate hikes last year and now may be the first to stop raising, although doing so presents a communications challenge for Governor Tiff Macklem.

The central bank seems set to wind down one of its most aggressive campaigns of monetary-policy tightening ever by boosting its key rate 25 basis points to 4.5% — a step back from December’s 50-basis-point increase and the even larger hikes of midyear.

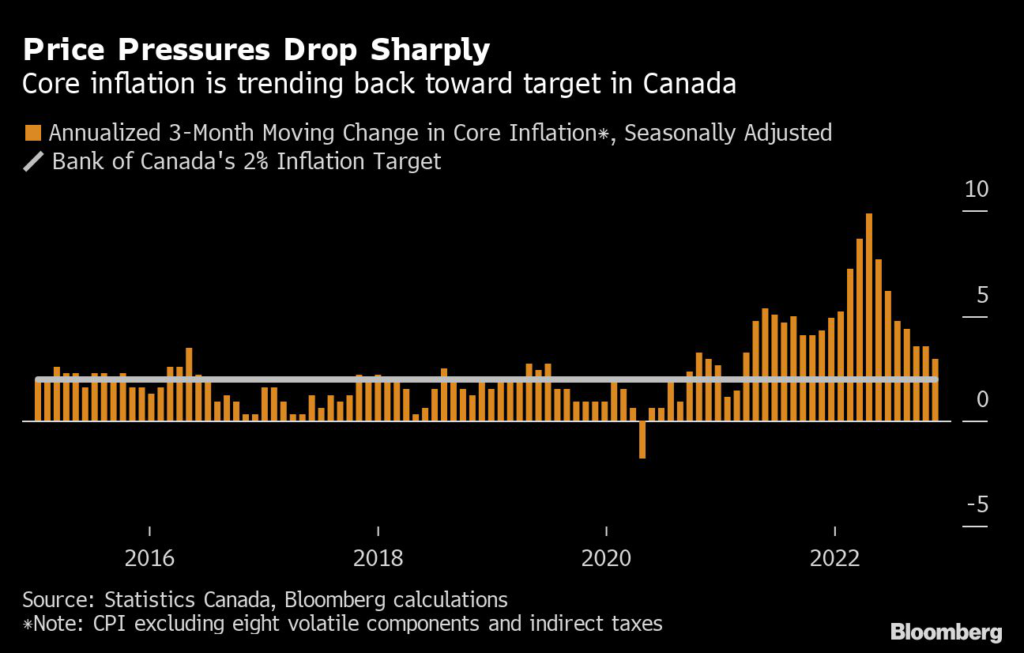

Abating price pressures explain the downshift and also provide Macklem with a reason to pause after lifting rates to the highest level in nearly 15 years. Markets and economists expect Wednesday’s move will be the last adjustment, with data showing inflation falling rapidly from a post-pandemic high.

The governor nevertheless needs to be careful in what he signals. A time out gives him space to assess how Canada’s indebted households and rate-sensitive real estate sector are handling bigger interest payments. But if he appears to declare victory over inflation, he risks creating looser financial conditions that could ignite price pressures anew.

That means Macklem and officials are likely to say that they’re weighing whether borrowing costs will need to rise further, maintaining a hawkish tone and leaving them space to raise rates again should they deem it necessary.

“Engraving an explicit pause in the statement would firm up market calls for rate cuts later this year,” Dominique Lapointe, director of macro strategy at Manulife Investment Management, said by email. “It would also take away the bank’s flexibility for more rate hikes if inflation surprises to the upside.”

How Macklem fares will be eyed by other central banks. Federal Reserve Chair Jerome Powell is among those feeling his way to a peak in rates after last year’s crackdown on inflation.

The Bank of Canada’s task, however, is complicated by mixed signals in recent data. While headline inflation has eased to 6.3% from a peak of 8.1% in June, expectations remain elevated and wages are rising.

There’s also sparse evidence of any rapid gearing down of economic growth. Canada’s red-hot labor market continued to add jobs at the end of last year, and fourth-quarter gross domestic product likely expanded at more than double the pace of the central bank forecast in October.

Policymakers will release new quarterly projections Wednesday alongside the 10 a.m. rate decision in Ottawa. Macklem and Senior Deputy Governor Carolyn Rogers will speak to reporters an hour later.

The new forecasts may show the economy headed for a so-called “soft landing,” with output flat or even contracting modestly at the start of 2022 and inflation falling toward the central bank’s 1% to 3% control range by the end of the year.

Still, risks are mounting as Canada’s households feel the pinch of higher rates. Housing activity has slowed dramatically, with benchmark prices falling 13% from their peak and dragging on net worth.

That’s expected to dent consumer spending more than in other Group of Seven countries, including the US — a big reason why markets and most economists see the Bank of Canada stopping rate hikes before the Fed.

“If they keep going, it might be a really tough hangover for Canada,” Jimmy Jean, chief economist at Desjardins Securities, said by phone. “If you continue to react to backward-looking data, that’s when you make a mistake.”

The Bank of Canada set the stage for a potential pause with a change in language that accompanied December’s hike.

Policymakers said they were now considering “whether the policy rate needs to rise further” to tame inflation, instead of how high borrowing costs would need to rise. In a speech the next day, the bank signaled future policy moves would be “more data-dependent,” keeping the option of larger hikes on the table.

This week’s decision also comes amid increased political scrutiny.

On the right, the Conservatives have targeted the central bank since the pandemic, alleging it financed Prime Minister Justin Trudeau’s deficit spending through its purchases of government bonds. On the left, the labor-friendly New Democratic Party is calling for an end to hikes. The head of Canada’s largest private-sector union, meanwhile, accused Macklem of waging a class war.

With its credibility being openly questioned, the bank announced last year it would increase transparency around its policymaking. A minutes-like summary of Wednesday’s decision will be published on Feb. 8, marking the first time the Canadian public gets a glimpse the governing council’s deliberations.

Those discussions will almost certainly hinge on how officials interpret the mixed run of data.

“If we are surprised on the upside, we are still prepared to be forceful,” Deputy Governor Sharon Kozicki said in Montreal on Dec. 8. “But we recognize that we have raised interest rates rapidly and that their effects are working their way through the economy.”

–With assistance from Randy Thanthong-Knight and Derek Decloet.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.