(Bloomberg) — Jerome Powell and Wall Street are headed for another face-off this week as the Federal Reserve seeks to slow its inflation-fighting campaign without signaling a readiness to stop.

(Bloomberg) — Jerome Powell and Wall Street are headed for another face-off this week as the Federal Reserve seeks to slow its inflation-fighting campaign without signaling a readiness to stop.

Despite 2022’s slew of interest-rate hikes from Chair Powell and colleagues, financial conditions are the loosest since last February as investors bet fading inflation will allow the central bank to soon cease raising borrowing costs and then cut them later this year.

That’s likely wishful thinking as far as Powell is concerned and he has a clear incentive to push back against the trade given rising stocks and bonds could fan the very price pressures he wants to restrain.

Such a backdrop means Powell is expected to balance this week’s likely 25 basis-point increase in rates with a stern message that the step down in size from the past six hikes doesn’t diminish his commitment to reducing inflation to 2%. It stood at 5% in December. He may even be willing to roil the upbeat markets if that’s what it takes to make his point.

“He can just send a hawkish message,” said Ethan Harris, head of global economics research at Bank of America Corp. “I don’t think he’s going to want the markets rallying out of this meeting. He doesn’t want to throw more gasoline on this kind of optimistic spin” fueling the markets.

Powell has sometimes struggled to get markets to take him at his word. In July, investors divined a policy pivot from his post-meeting press conference even though he stressed the need to keep raising rates. That then gave rise to a strikingly hawkish speech by Powell the following month at the Fed’s Jackson Hole conference to hammer the message home.

Fed officials look set to raise rates by a quarter-point to a range of 4.5% to 4.75%, following a half-point hike last month and four straight 75 basis-point increases, representing the most aggressive tightening campaign in four decades.

Still, financial conditions are now looser than in March when policymakers began to raise rates, and minutes of their December meeting show that this was already on their minds. Officials noted that an “unwarranted” easing in conditions would complicate their task of restoring price stability.

Dallas Fed President Lorie Logan, speaking on Jan. 18, cautioned that policy could respond if financial conditions ease further in response to a slower pace of rate increases.

“If that happens, we can offset the effect by gradually raising rates to a higher level than previously expected,” she said.

What Bloomberg Economics Says…

“For the Fed, with financial conditions loosening, the burden of controlling elevated inflation falls increasingly on hopes for favorable supply shocks. If that doesn’t happen, our model suggests Powell & Co. have more work to do to convince investors they’re serious about getting inflation back to their 2% target.”

— Martin Ademmer and Bjorn Van Roye (economists)

To view the full note, click here

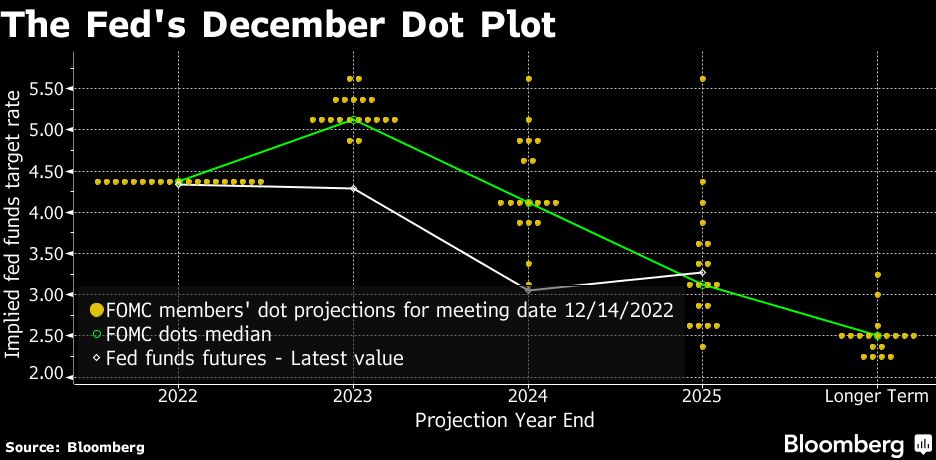

Traders are firmly pricing in a quarter-point rate hike at the upcoming meeting, with a second move of the same size largely set for the March meeting. Traders expect a peak policy rate around 4.9% by May and June, falling to below 4.5% by the December meeting and with further cuts indicated during 2024.

By contrast, the central bank’s December forecasts showed 17 of 19 officials projecting rates above 5% this year, with two of them above 5.5%.

“They need a greater tightening of financial conditions than they’re seen,” said Sonia Meskin, head of US Macro at BNY Mellon. “The Fed has struggled with this particular issue throughout 2022 and it seems that the struggle is now being continued into 2023. They are worried about it.”

Financial conditions are critical to the Fed’s effort to reduce growth below its long-term trend in the face of a resilient economy. Gross domestic product expanded at a 2.9% annualized rate in the final three months of 2022, while initial unemployment claims fell to the lowest since April in a sign of a continued tight labor market.

“The Fed will deliver a hawkish press conference,” said Gargi Chaudhuri, the head of iShares investment strategy for the Americas at BlackRock Inc. “I imagine Chair Powell pushes back on the number of cuts priced in by the market before the end of this year. The tight labor market is giving them the opportunity do so.”

There are several ways tight conditions reduce growth, and if taken far enough, can induce a recession. Rising mortgage rates cool off the housing market, and higher lending rates can make corporate investments more expensive. A stronger dollar hurts manufacturing by making exports more pricier and imports cheaper. And lower stock and bond prices can help restrain consumer spending through a wealth effect.

With the exception of Logan’s comments, policymakers have not gone out of their way to discuss financial markets.

“There has not been a concerted effort on the committee to push back against looser financial conditions,” said Steve Bartolini, portfolio manager fixed income at T. Rowe Price. “I would be surprised if Powell does not push back, and likely against the market pricing in rate cuts for the back half of his year.”

Powell’s press conference could be tricky as he will need to acknowledge that the inflation outlook has improved – one of the factors driving recent gains in stock and bond prices – while stressing the need for still higher rates to bring inflation down to the Fed’s 2% target.

The goal now is “to keep the financial markets from pricing in a premature pause and lean against the bond market’s expectation of rate cuts in the second half of 2023, which would lead to further unwanted easing in financial conditions,” said Kathy Bostjancic, chief economist at Nationwide. “You are leaning against the markets becoming too dovish. That is another reason for him to stay resolutely hawkish and to say that inflation is still our number one concern.

–With assistance from Catarina Saraiva.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.