India’s government said it will focus on rebuilding fiscal space lost during the pandemic to counter new risks from a challenging global environment, which has already begun weighing on domestic demand.

(Bloomberg) — India’s government said it will focus on rebuilding fiscal space lost during the pandemic to counter new risks from a challenging global environment, which has already begun weighing on domestic demand.

“With the continuing global risks and uncertainties, the availability of fiscal space with the governments has become paramount,” according to the Economic Survey — an annual report card on the economy — tabled in Parliament by Finance Minister Nirmala Sitharaman Tuesday.

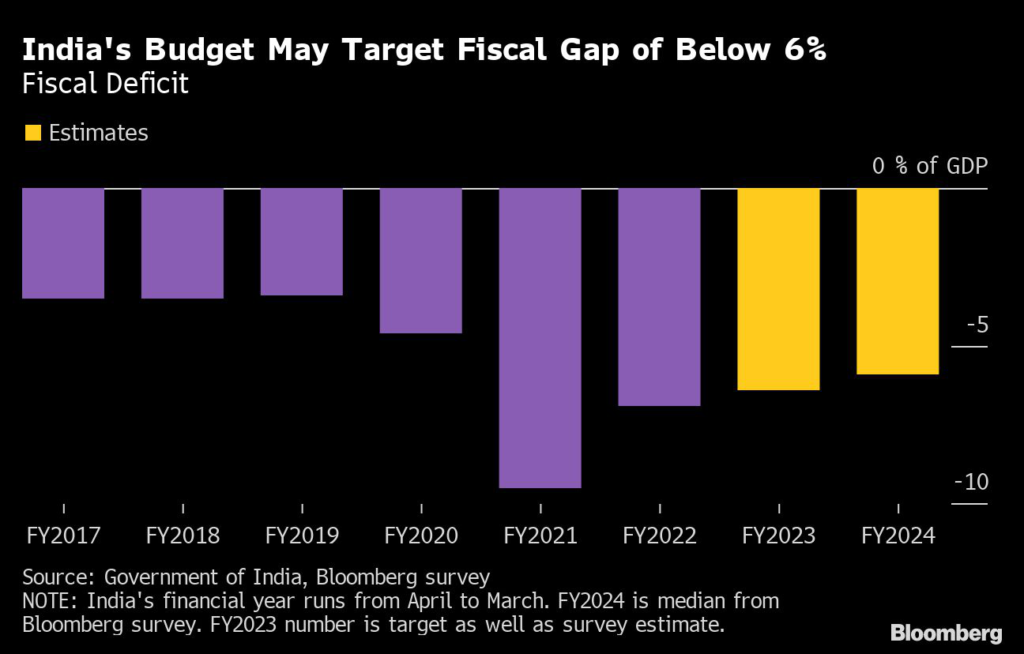

The Survey, which comes a day ahead of the government’s annual budget presentation on Wednesday, suggested the government would stay fiscally prudent to leave room for more policy action in uncertain times, while reining in the budget deficit at 6.4% of gross domestic product this year.

“There is a need for continued vigilance and adherence to the path of fiscal prudence, but an undue alarm is unwarranted,” the finance ministry’s report said.

Sticky global inflation and high borrowing costs are hurting growth, including in emerging markets such as India. The economy, which bounced back strongly from the pandemic-induced contraction, has since lost speed due to tightening financial conditions and supply chain disruptions from a prolonged war in Europe.

The Survey, authored by the finance ministry’s Chief Economic Adviser V Anantha Nageswaran, expects GDP growth of 6.5% in the fiscal year starting April, compared with the 7% expansion estimated for the current year. That reading is higher than the International Monetary Fund’s projection for 6.1% growth — which will still make it the quickest pace among major economies.

The ministry’s assessment lays the groundwork for Prime Minister Narendra Modi government’s final full-year spending plan before a 2024 national vote.

The government is widely expected to deliver a growth-oriented budget, while resisting the temptation to turn populist. Economists surveyed by Bloomberg see Sitharaman relying on asset sales and cutting subsidies to maintain infrastructure expenditure and contain the fiscal deficit.

The government is seen borrowing a record 15.8 trillion rupees ($194 billion) in the next fiscal year starting April to partly meet its spending requirements. Shorter-dated Indian bonds erased some of the losses after dropping Monday on worries the government may raise its current fiscal year’s borrowings from 14.2 trillion rupees.

The rupee may remain under pressure from further interest-rate hikes by the US Federal Reserve, but slowing global growth may push down commodity prices and improve India’s current account balance, the Survey said.

–With assistance from Subhadip Sircar.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.