Every recent weekday morning at dawn, a line has formed outside the 19th century granite headquarters of the Bank of Spain in downtown Madrid. Savers from across the city have come to get their hands on something unheard of for more than a decade: a return of nearly 3%.

(Bloomberg) — Every recent weekday morning at dawn, a line has formed outside the 19th century granite headquarters of the Bank of Spain in downtown Madrid. Savers from across the city have come to get their hands on something unheard of for more than a decade: a return of nearly 3%.

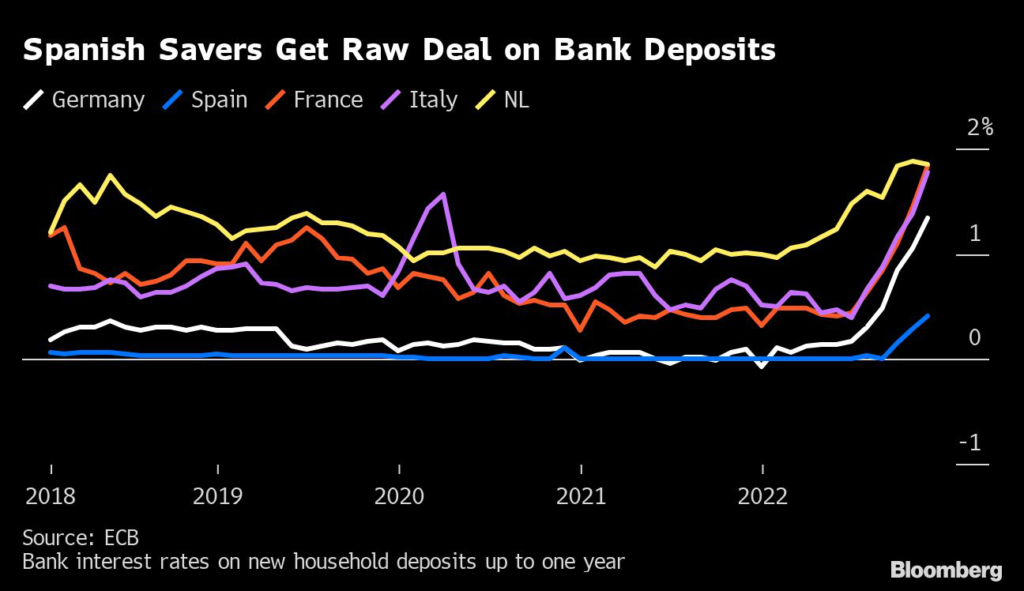

Although interest rates have been rising in Europe since the middle of last year, Spanish lenders have so far opted not to pass on much of the increase to retail customers, choosing instead to pocket the difference.

So when word got out that there are much bigger returns to be had from short-dated debt, known as letras, demand to place orders soared.

“Banks are paying almost nothing for deposits, while here I get a much better return — and it’s safer,” said Fermín Bódalo, a 79 year-old pensioner waiting in line in temperatures barely above freezing. “It’s the obvious thing to do.”

Spanish banks are among the most miserly in the euro zone when it comes to passing on interest to retail savers. They offer a rate of just 0.4% on new term deposits for up to 12 months, according to the latest data from the European Central Bank. By contrast, savers in Italy and France were being paid an annual rate of about 1.8% for new deposits as of November, while their counterparts in Germany earned 1.3%.

The trend is giving Spain’s big lenders an opportunity to boost their earnings, but it also risks discouraging people from saving money at a time when policy makers are trying to tame an inflation rate that’s still above 5%. Aggressive rate hiking by the ECB still hasn’t followed through to retail deposits “to any appreciable degree,” the Bank of Spain said in its Autumn financial stability report.

The ECB wants banks to pass on rate hikes because they want people to save, said Daragh Quinn, an analyst at broker KBW. “If they don’t, the transmission mechanism isn’t really working,” he added.

One place where interest rates are being passed on is the mortgage market, with the one-year euribor, the reference rate for most floating-rate Spanish home loans, now higher than 3%. That means consumers are paying more to borrow, but still not being compensated with higher returns on savings.

The Spanish Banking Association, the AEB, declined to comment.

Earnings Boost

Analysts expect the trend to show up in the earnings of big Spanish lenders when they report later this week.

CaixaBank SA, which dominates the Spanish retail banking scene, is set to book a 12% annual boost to 2022 net interest income when it reports earnings on Feb. 3, according to a Bloomberg survey of analysts. The analysts predict a further 24% surge in that revenue line this year. Spain’s other retail banking behemoths, Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA, will also give updates.

Spanish lenders don’t need the cash. After the long years of ultra-low interest rates, they’re awash with sight deposits, or money that can be withdrawn with little or no notice. Retail and corporate deposits account for more than half of the total liabilities of Spanish banks, compared with about 28% for those in Germany.

Fixed-term deposits accounted for just 6.6% of the total mix as of June last year, compared with 55% in 2011, according to the Bank of Spain. Spanish banks typically operate with loan-to-deposit ratios below 100%, meaning their reliance on customer savings to fund their loan growth is limited.

No Competition

Leopoldo Alvear, the chief financial officer at Banco de Sabadell SA, a mid-sized lender, said interest-rate increases have passed through to the bank’s Spanish liabilities at a “negligible” rate and the picture has barely budged in January. Banks don’t need to compete for large volumes of deposits, so there’s less pressure to offer higher returns, he added.

Customers with money to put to work are instead turning to the long lines outside the central bank. Demand is so high that the bank is attempting to lower waiting times with a new online booking system.

While it’s possible to place orders for government debt via the Treasury website, the process requires jumping through digital identification hoops. Even so, online debt purchases by retail investors spiked to almost 400 million euros ($435 million) in January, about as much as the total sold for the whole of last year. No data was available on over-the-counter bond sales.

“We’re all here because the banks are paying us almost nothing,” said Jose Martin, 49, clutching a leather document case as he stood in the cold. “They’re keeping it all for themselves.”

–With assistance from Ainhoa Goyeneche and Alonso Soto.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.