Analysts are betting that Advanced Micro Devices Inc. will be one of the few semiconductor companies that grows in 2023 even as talk of a downturn in the chip sector dominates the headlines.

(Bloomberg) — Analysts are betting that Advanced Micro Devices Inc. will be one of the few semiconductor companies that grows in 2023 even as talk of a downturn in the chip sector dominates the headlines.

The semiconductor company will report rising sales and earnings this year, Wall Street firms say, and they expect the stock price to follow: AMD’s shares are likely to jump 19%, based on brokers’ average price target, more than its biggest US peers such as Intel Corp. and Nvidia Corp.

The bullishness reflects AMD’s steady progress in chipping away at Intel’s hold on the lucrative market for processors used in server computers, as well as possible gains when Meta Platforms Inc. re-accelerates spending on chips used to power its metaverse project. AMD’s fourth-quarter results, due after the market closes Tuesday, are likely to show a small sales increase and investors will be focused on the outlook for this year.

“AMD is still posting reasonably strong growth in its key data-center unit while Intel is sputtering,” said Dan Morgan, a senior portfolio manager at Synovus Trust Co., which owns stakes in both companies.

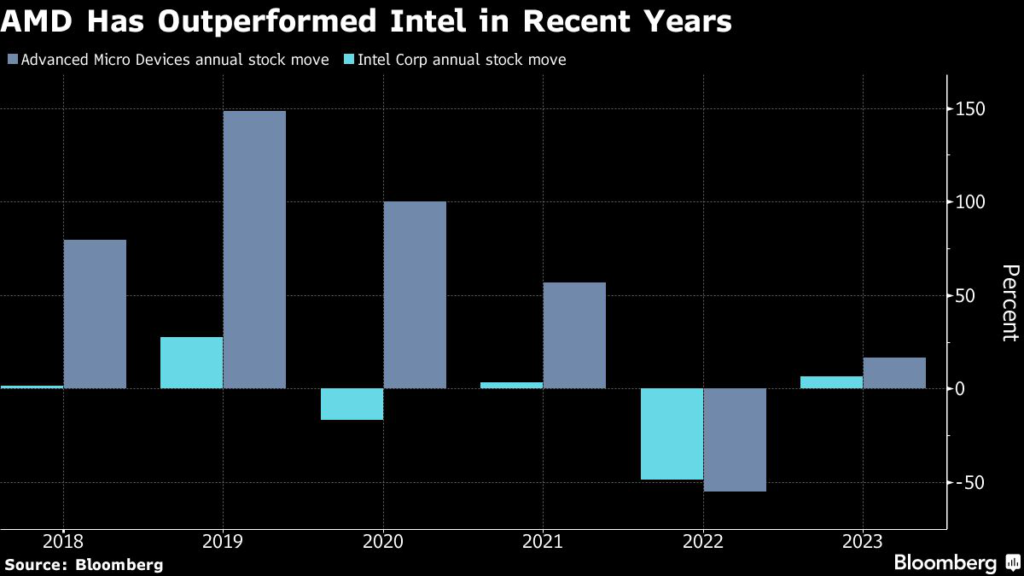

A year of outperformance against Intel would mark a return to form for AMD after a disappointing 2022, when the stock lost more than half its value versus a 49% drop for Intel.

That aside, AMD has been on a more than two-decade run versus Intel: At the peak of the internet stock bubble in 2000, Intel was the industry whale, with a market value of $500 billion, while AMD was a minnow at $11.7 billion. Now the companies are roughly the same size at about $116 billion.

Intel has been slow to introduce new products in recent years, allowing AMD to lure away customers, and now it’s getting hit by the slowdown in personal-computer sales. Intel last week forecast one of the worst quarters in its history, and the company is eliminating jobs and slowing spending on new plants in an effort to save as much as $10 billion.

AMD, meanwhile, probably will report a 3% increase in earnings per share this year and a 6% rise in revenue, based on the average analyst forecast. Intel is forecast to report double-digit declines in both measures.

Earnings for chip companies more broadly will fall 21% this year, according to analyst estimates compiled by Bloomberg Intelligence, At the end of October, they were expected to drop 9.1%. There’s been a similar trend for revenue, which analysts see falling 6.9, compared with a 0.6% decline expected three months ago. Samsung Electronics Co., which supplies semiconductors used in Apple Inc.’s iPhones, said Tuesday it expected a recovery in chips to begin only in the second half of the year.

Intel still dominates the market for processors used in servers, with a share of more than 70%, according to Mercury Research. However, its hold on that lucrative market has slipped as the chipmaker was slow to introduce new products in recent years and some customers also develop in-house chips to replace Intel processors.

Blayne Curtis from Barclays Plc upgraded AMD to overweight last week, saying that the company’s platforms should drive further share gains versus Intel this year. Given the high expectations in the stock, a disappointment won’t be taken well.

“AMD’s report and guidance is going to be very important for the stock,” said Matthew Maley, chief market strategist at Miller Tabak + Co. “If their guidance is negative despite the fact that they’re taking market share from Intel, it’s going to be very negative. It’s going to tell us that the entire industry is under even more pressure than they were in the second half of last year.”

Tech Chart of the Day

The rebound in the Nasdaq 100 has propelled the index to breach its downward trend line. The tech-heavy gauge has risen for four consecutive weeks, its longest streak of weekly gains since August last year. The index was trading up 0.4% on Tuesday.

Top Tech Stories

- Samsung made a surprisingly aggressive decision to keep capital spending at the same level as last year, defying expectations it would go along with rivals in pulling back to alleviate pressure on an already-battered semiconductor industry. The company expects the smartphone market to contract in 2023.

- Twitter Inc. made its first interest payment on the $12.5 billion in debt that Elon Musk used to take the social media giant private last year.

- Comments by Apple executives and policies imposed on employees have been deemed illegal by US National Labor Relations Board prosecutors, who say they violate workers’ rights.

- NXP Semiconductors NV, the second-biggest supplier of chips to the automotive industry, fell about 4% in extended trading after giving a lackluster forecast on weakening demand for industrial and smart home components.

- Darktrace Plc’s stock fell to its lowest level since the UK cybersecurity company’s 2021 initial public offering following a report by Quintessential Capital Management detailing the reasons why it’s taken a short position.

- Online retailer Shein plans to appoint former SoftBank Group Corp. executive Marcelo Claure to help run its Latin American business, a signature hire that could accelerate a global expansion by one of world’s most valuable startups.

- Sony Group Corp. reduced projections for the initial launch of its PlayStation VR2 headset dramatically after early pre-orders disappointed, signaling little improvement for the hyped-but-unproven virtual reality sector.

- The Biden administration is considering cutting off Huawei Technologies Co. from all of its American suppliers, including Intel and Qualcomm Inc., as the US government intensifies a crackdown on the Chinese technology sector.

- Alibaba Group Holding Ltd.’s biggest selloff in three months is underscoring investor concern that China’s consumer recovery may fail to meet lofty expectations.

–With assistance from Ryan Vlastelica and Michael Msika.

(Updates at market open.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.