A blistering rally in the cobalt market is turning into a rout, putting pressure on miners and offering tentative cost relief for carmakers after a surge in battery metal prices last year.

(Bloomberg) — A blistering rally in the cobalt market is turning into a rout, putting pressure on miners and offering tentative cost relief for carmakers after a surge in battery metal prices last year.

Cobalt rallied sharply early in 2022 as demand for electric vehicles surged.

But while automotive usage is still rising, there’s been a sharp drop-off in buying from another key sector — Chinese electronics — and cobalt prices have crashed more than 50% since a peak in May.

Pound for pound, the batteries used in laptops, phones and tablets contain much more cobalt than EV batteries, and demand from the industry has fallen about 30% to 40% over the past year, according to researcher Rystad Energy.

At the same time, demand growth for use in EVs is moderating as more manufacturers shift to battery chemistries that don’t require cobalt.

Ford’s Flurry of Supply Deals Gives Iron a Starring Role in EVs

For carmakers, cobalt’s boom-to-bust swing will have a minor impact on the cost of batteries, when compared with other materials like lithium, which is used in much greater volumes and is still trading at sky-high levels.

Yet the collapse offers a stark illustration of how quickly the balance between buyers and sellers can shift in the small but rapidly expanding markets for battery metals.

“The distinction between cobalt and lithium is that carmakers are very eager to get hold of lithium, while they’re doing everything they can to get rid of cobalt,” Michael Widmer, head of metals research at Bank of America Corp., said by phone.

“The individual dynamics are very different, but where we’ve seen commonality in the battery metals markets is in the fact that massive rallies can quickly be followed by massive declines.”

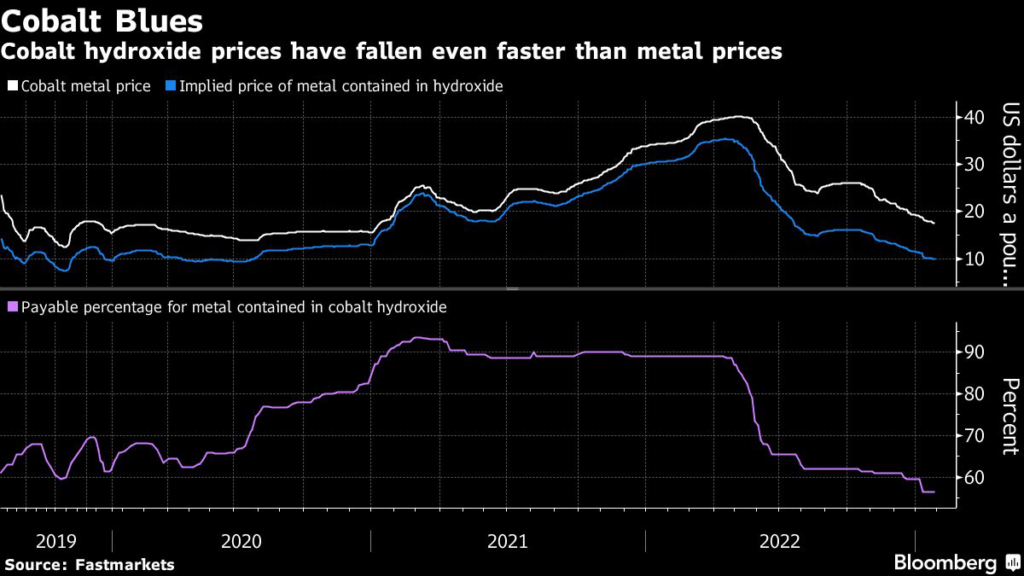

The pressure is particularly evident for producers of cobalt hydroxide, a semi-refined product that accounts for the bulk of global supply.

It typically trades at a discount to the pure metal, but the gap has widened dramatically in recent months — in some cases, miners are only getting paid for a little more than half of the cobalt contained in the hydroxide they sell, down from about 90% a year ago.

The crash has also been amplified by changes in the way that cobalt is priced.

Until 2018, top producer Glencore Plc typically priced its hydroxide at a fixed discount to metal under annual contracts, but some customers looked to back out of the deals after a wave of new supply caused discounts to widen dramatically in the spot market, according to people familiar with the deals.

Glencore has since been pricing much more of its material with a floating reference to the prevailing discounts in the spot market, in a move that’s likely to reduce the risk that buyers will look to walk away from unprofitable contracts this time around.

However, it’s also amplified the miner’s exposure to the slump in prices and demand.

Under some contracts, Glencore has been selling cobalt hydroxide at its steepest-ever discount to the price of the finished metal, according to people familiar with the matter.

While the slump is unlikely to be much of a concern at a time when Glencore is reaping huge profits elsewhere, the prices it’s receiving for hydroxide are now approaching a nadir seen in 2019, when its trading business took a $350 million first-half loss on cobalt that was mined, but it couldn’t sell.

The challenges that have come with cobalt’s wild swings are emblematic of broader commercial growing pains being experienced by miners, consumers and financiers in the markets for battery metals.

Unlike much larger commodity markets like copper and oil, cobalt has been nearly impossible to hedge in large volumes until recently, and so the gyrations seen in the past few years have been particularly painful for carmakers on the way up, and for miners on the way down.

This time, though, buyers and sellers have been flocking to a CME Group cobalt contract to hedge their exposure, setting the stage for a potentially seismic shift in the way the industry manages its price risks.

Lithium trading has also been picking up on the exchange, and while volumes are still tiny in relation to global supply, advocates say the contracts will have an increasingly large role to play as the electric vehicle industry expands rapidly.

“It’s going to be very important to get the contracts up and running,” said Widmer at Bank of America, which has been making markets for clients who want to trade the CME contracts.

“Given the price volatility we have in these markets, risk management tools like this are going to be increasingly helpful.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.