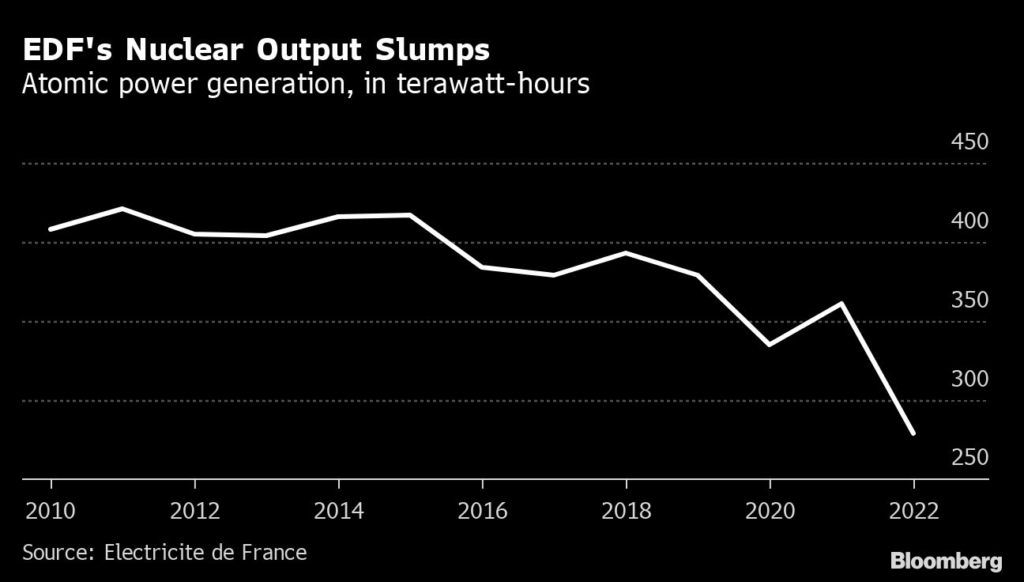

Electricite de France SA reported a historic loss for 2022 after repairs choked its nuclear output, but the utility predicted a significant rebound in earnings this year as production recovers.

(Bloomberg) — Electricite de France SA reported a historic loss for 2022 after repairs choked its nuclear output, but the utility predicted a significant rebound in earnings this year as production recovers.

The state-controlled generator swung to a net loss, excluding non-recurring items, of €12.7 billion ($13.5 billion) last year after a profit of €4.7 billion in 2021, according to a statement on Friday.

The company’s woes exacerbated the region’s energy crisis by turning France — traditionally a powerhouse producer — into a net importer of electricity.

President Emmanuel Macron’s government, which is trying to regain full ownership of the nuclear giant to reassure creditors, wants new Chief Executive Officer Luc Remont to restore production and prepare the company to start building new reactors in France and the UK.

Read more: Cracking Under Pressure: The Race to Fix France’s Nuclear Plants

EDF was forced to buy back its production shortfall on the wholesale market last year as the energy crunch pushed prices to records.

The company also suffered from a price cap set by the government to protect consumers, and it’s is seeking compensation worth €8.34 billion before the Paris administrative court for losses arising from the mechanism.

As a result, it posted a loss before interest, taxes, depreciation and amortization of €5 billion last year, compared with positive Ebitda of €18 billion in 2021.

“The target for 2023 is to improve operational performance,” the CEO said on a call with reporters.

“The aim is to achieve an Ebitda that will be significantly higher than in 2021.”

The group is targeting its net financial debt to be no more than three times Ebitda at the end of 2023. EDF’s net financial debt soared 50% to €64.5 billion in 2022.

EDF reiterated that its French nuclear output, which dropped 23% last year to 279 terawatt-hours, will be in a range of 300 to 330 terawatt-hours in 2023.

As EDF’s technical and financial challenges mounted last year, the French government launched a €9.7 billion offer to buy out minority shareholders.

While it raised its ownership to 96% from 84%, the government decided to pause the completion of the deal pending the outcome of a legal claim from employees and other shareholders that the €12-per-share offer undervalues the company.

The Paris Appeals Court is due to rule on the state’s offer by May 2.

Read more: France’s Lower House Advances Bill to Block EDF Asset Sales

(Updates with CEO comments on 2023 Ebitda in sixth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.