Federal Reserve officials could shed light on how many policymakers saw the case for a larger interest-rate increase at their last meeting and whether they anticipated the need to take rates higher than previously thought to tame persistently high inflation.

(Bloomberg) — Federal Reserve officials could shed light on how many policymakers saw the case for a larger interest-rate increase at their last meeting and whether they anticipated the need to take rates higher than previously thought to tame persistently high inflation.

US central bankers will publish minutes at 2 p.m. Wednesday of their Jan. 31-Feb. 1 gathering, at which they voted unanimously to raise rates by just a quarter percentage point.

That was a moderation from their half-point hike in December after four consecutive jumbo-sized 75 basis-point increases. The action brought the Fed’s benchmark policy rate to a target range of 4.5% to 4.75%.

The minutes will be published after US stocks and bonds sank Tuesday amid speculation the Fed will raise rates further than investors anticipated just weeks ago. A series of Fed officials last week outlined ongoing inflation concerns.

The Fed’s policy statement on Feb. 1 said the “extent of future increases” in rates will depend on a number of factors including cumulative tightening of monetary policy, wording Fed watchers viewed as a signal the central bank may stick with 25 basis-point moves as it approaches the end of its tightening campaign.

“The minutes will express the strategic rationale for moving in 25s in terms that are similar to our own: to learn from the 1H data to what extent the resilient data to date reflected policy lags vs an economy that is more resilient to higher rates,” Evercore ISI’s Krishna Guha and Peter Williams wrote in a note to clients.

But two hawkish policymakers, Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard, said last week that they saw the case for doing another 50 basis-point hike at the meeting and that such larger moves should still be on the table for upcoming decisions.

Bullard, speaking on CNBC on Wednesday morning, repeated his view that the resilience of the economy shows the need for the Fed to keep raising rates and get policy to a sufficiently restrictive level as soon as possible.

“It has become popular to say well let’s slow down and feel our way to where we need to be. But we still haven’t got to the point where the committee put the so-called terminal rate,” he said. “I think we are going to have to get north of 5%. Right now I’m still at 5.375%.”

The readout of the gathering could offer insight on whether those two officials, who do not vote in monetary policy decisions this year, were alone in their thinking or if others shared their view. That said, Richmond Fed President Thomas Barkin pushed back against the possibility of returning to bigger hikes, saying on Friday that 25 basis-point increases give officials more flexibility.

Officials may set a high bar for returning to half-point rate increases. But if more policymakers supported preserving the option for a larger move, it could hint that the Fed may be open to taking rates higher than previously expected to quell strong inflation, said Omair Sharif, founder of Inflation Insights.

“That at least gives us some sense of potentially how quickly the Fed might shift if needed,” said Sharif. “If you think 50 is obviously on the table, then that probably suggests that the terminal rate is going to be higher as well.”

Projections issued at the Fed’s December meeting showed officials saw rates rising slightly above 5% this year and staying there for a while to bring inflation down to the central bank’s 2% target. Investors previously doubted that message, and were pricing in rate cuts for the second half of this year.

But on the heels of stronger economic data and hawkish messaging from some policymakers, markets now see the Fed extending its rate hiking campaign for longer than previously expected. Quarter-point rate increases are fully priced in for March and May and the odds of another such move in June are high. Investors see rates peaking at 5.37% this year, according to financial futures contracts.

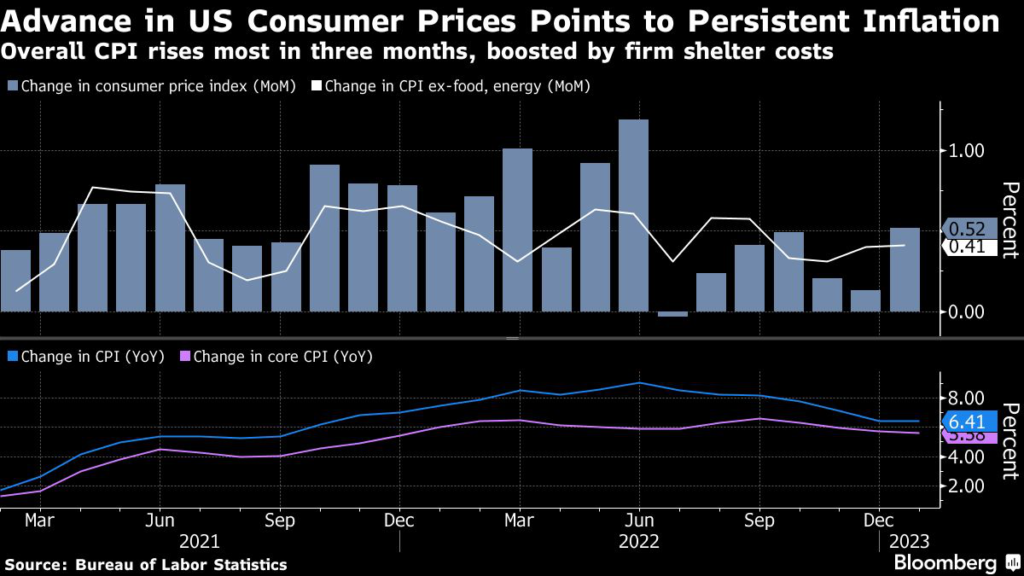

Recent economic reports showed robust retail sales, a stronger-than-expected rebound in US producer prices and consumer prices that are not slowing by as much as forecast.

The minutes could also reveal how officials interpreted the data they had on hand by the time of the meeting, offering clues on how they may be interpreting the strong data that’s been released since the gathering, said Sharif. A message that policymakers see the risks of doing too little to halt inflation as the greater risk when compared to hiking too much, could suggest that officials are prepared to take rates higher, he said.

Fed Chair Jerome Powell told reporters after the meeting earlier this month that upcoming projections, which officials will pencil in for their March 21-22 meeting, will be determined by what happens with inflation.

“It could certainly be higher than we’re writing down right now,” Powell said. “At the same time, if the data come in, in the other direction, then we’ll, you know, we’ll make data dependent decisions at coming meetings.”

–With assistance from Vince Golle.

(Updates with Bullard comment to CNBC in eighth and ninth paragraphs.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.