The last week saw major UK banks line up to report fourth-quarter earnings. One of the main themes: buybacks are back.

(Bloomberg) — The last week saw major UK banks line up to report fourth-quarter earnings. One of the main themes: buybacks are back.

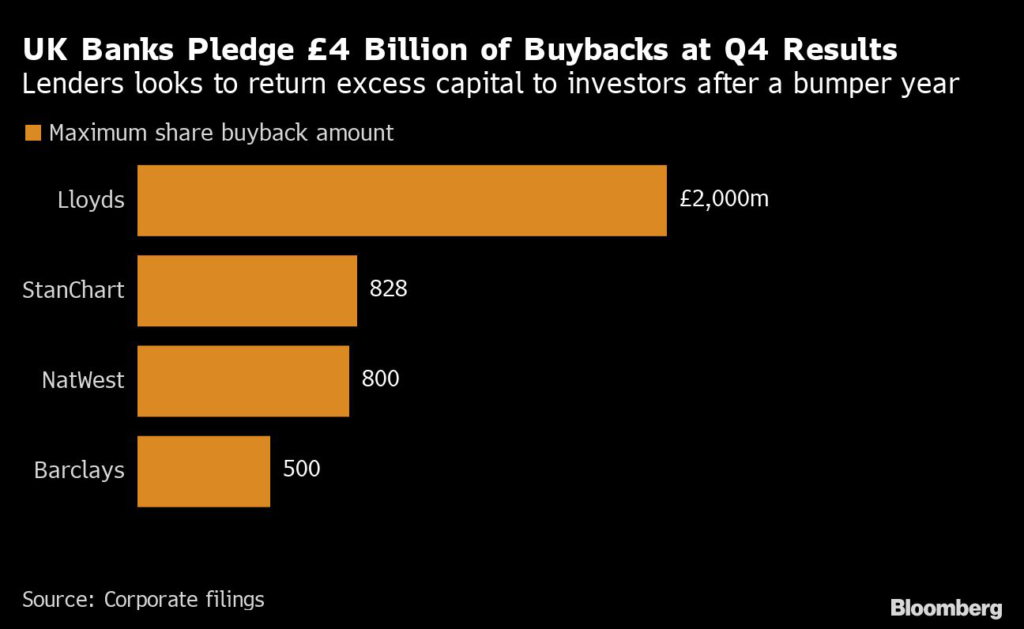

Lloyds Banking Group Plc’s £2 billion ($2.4 billion) share buyback announcement on Wednesday came after Barclays Plc, NatWest Group Plc and Standard Chartered Plc pledged to return more than £2 billion combined to their shareholders.

HSBC Holdings Plc, Europe’s biggest lender, didn’t give a figure but said it would consider restarting buybacks in May, earlier than it has previously guided. It also pledged a special dividend once the sale of its Canadian unit is completed.

The payouts come after a year of margin growth fueled by soaring interest rates. That, coupled with relatively low levels of souring loans, has left firms with plenty of excess capital to return.

The trend mirrors that of continental banks, where nine top euro area banks plan to return more than €30 billion ($31.9 billion) in buybacks and dividends this year.

While buybacks in theory make the shares left in circulation more valuable, the past week shows that isn’t always reflected by reality. Shares in Lloyds, Barclays and NatWest all dropped on the day they unveiled their results as investors looked ahead to a worsening economic outlook.

Read More: NatWest Stock Slump Shows Investors Want More Than Just Buybacks

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.