The rand is treading water at R15.75 against the US dollar following the decision of the South African Reserve Bank to hike interest rates by 25 basis points.

It strengthened a couple of cents immediately after the announcement which takes the repo rate, the rate at which the SARB lends money to commercial banks, to 3.75%, and the prime lending rate to 7.25%.

The decision to hike was split 3-2.

“Following the initial move lower the rand has since lost 15 cents after the announcement and is currently trading at R15.75. It seems that there is a broad EM ‘risk-off’ play in the market at the moment,” comments TreasuryONE.

In other emerging markets, the Turkish central bank has cut interest rates by 100 basis points, sending the Turkish lira to a record low and placing further pressure on EM currencies.

Hungary hiked rates by 70 basis points.

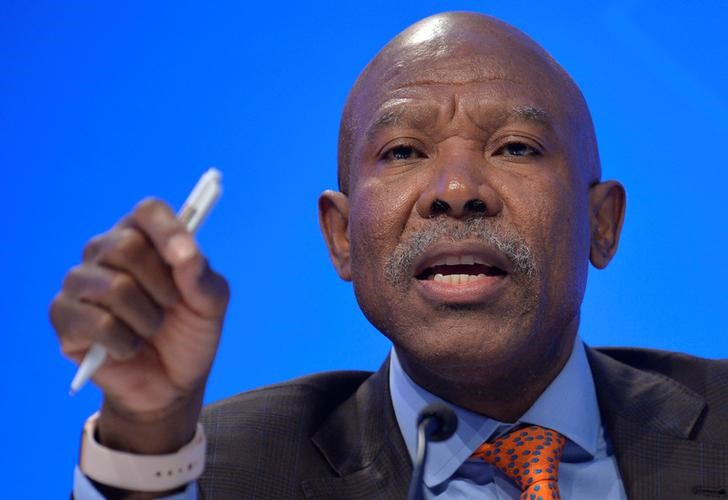

The unit, which opened trading this morning at R15.46, has depreciated by 5.9% since the last SARB MPC meeting in September, SARB Governor Lesetja Kganyago said.

Citing rising global producer price and food price inflation, surging oil and electricity prices and other administered prices, Kganyago warned that the risks to the short-term inflation outlook are assessed to the upside.