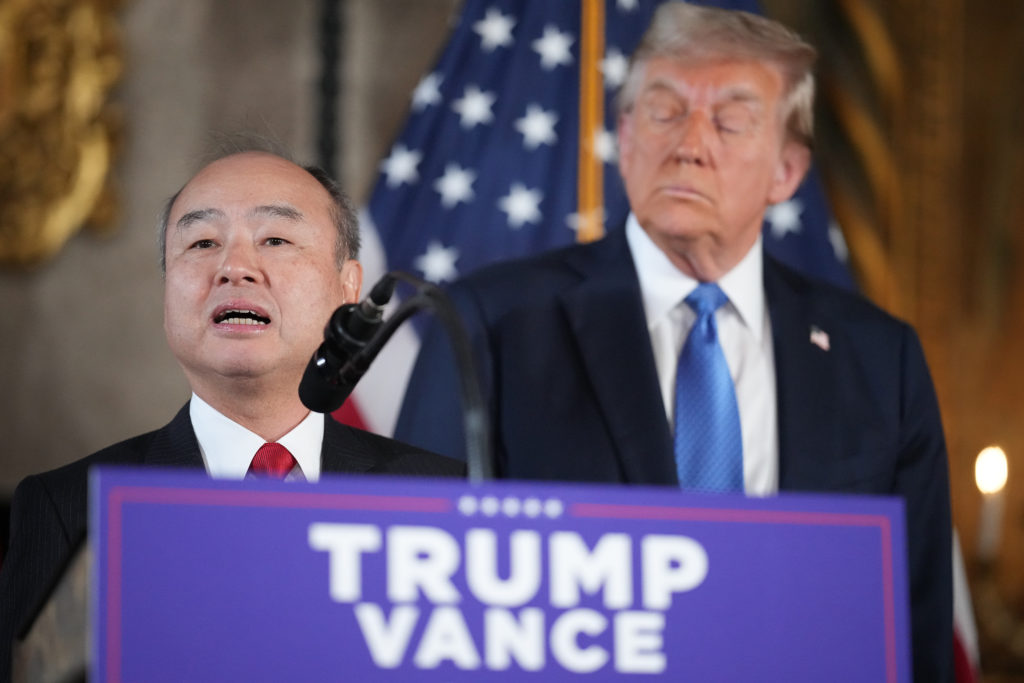

The Japanese tech titan SoftBank will invest $100 billion in the United States, creating at least 100,000 jobs, US President-elect Donald Trump said Monday, in a boost to his incoming administration.”This historic investment is a monumental demonstration of confidence in America’s future,” Trump said during a press conference at his Mar-a-Lago residence in Florida. “It will help ensure that artificial intelligence, emerging technologies and other industries of tomorrow are built, created and grown right here in the USA,” added Trump, who takes office from US President Joe Biden next month.Speaking alongside Trump, SoftBank’s chief executive Masayoshi Son confirmed the investment company’s financial commitment and pledged to create 100,000 jobs, adding that Trump’s victory had “tremendously increased” his confidence in the American economy. “I am truly excited to make this happen,” added Son, 67.- Second commitment -The announcement from Son is around double the amount he committed SoftBank to in December 2016, shortly before Trump began his first term as president. The Japanese firm ultimately parted with close to $100 billion through its Vision Fund, with much of the money supplied by sovereign wealth funds in Saudi Arabia and the United Arab Emirates.”President Trump is a double-down president,” Son said on Monday, adding: “I’m going to have to double down.” Stephen Moore, an economic advisor to Donald Trump, said the announcement marked a “great day.””The importation of capital into the US is a huge leading indicator for jobs and prosperity to come,” Moore, an economist at the conservative Heritage Foundation, told AFP in a message.- Cutting red tape -Son made his name with successful early investments in Chinese e-commerce titan Alibaba and internet pioneer Yahoo, but has also bet on catastrophic failures such as WeWork.He has repeatedly said that “artificial superintelligence” will arrive in a decade, bringing new inventions, new medicine, new knowledge and new ways to invest.Last month, CNBC reported that ChatGPT creator OpenAI will enable its employees to sell shares worth roughly $1.5 billion to SoftBank.The SoftBank Group posted a bumper second-quarter net profit last month, returning to the black after net losses in the first quarter and the previous financial year.Son’s announcement is a boost to the incoming Trump administration, which takes office on January 20, 2025. On the campaign trail, Trump pledged to boost the US economy by cutting red tape and fast-tracking investments, including into the oil and gas sector.Some analysts have voiced concerns that several Trump proposals, such as slapping new tariffs on US imports and deporting millions of undocumented workers, could hurt growth and cause a spike in inflation.”The increased likelihood of substantial new tariffs on US imports would have the most consequential effect on economic growth,” economists at Wells Fargo wrote in a recent note to clients, adding they had “bumped up” their inflation outlook and slightly cut their GDP forecast.Other analysts say the level of economic pain caused by Trump’s tariff plans will largely depend on how widespread they are. “The impact on inflation need not be particularly significant for monetary policy,” economists at Goldman Sachs wrote in a recent investor note. But, they added “this could change if the White House imposes a 10% universal tariff,” referring to one of Trump’s proposals on the campaign trail.

Mon, 16 Dec 2024 18:10:45 GMT