The JSE took a breather from its record run fueled by easing omicron fears in the previous session, with investors cashing in on recent huge jumps in share prices and as commodities backtracked. Investors also received the earliest studies on omicron with cautious optimism.

Bloomberg reports research from South Africa, Sweden and Germany, as well as from Pfizer and BioNTech shows that omicron does cause a loss of immune protection, but potentially not a complete one. And while vaccines may be less powerful against the new variant, protection can be fortified with boosters.

Commodity prices all gave up their gains as growth fears receded, pulling stocks down with them, with gold and platinum stocks leading the dip. Northam lost 4.88% and Implats 4.03% after the suitors for Royal Bafokeng (-0.68%) both upped their stake in the smaller platinum producer. Amplats was up 0.32%.

Gold counters losing their shine included Harmony (-4.45%), Gold Fields (-4.14%) and Anglogold (-3.85%). Sibanye-Stillwater lost 2.39% after the National Union of Mineworkers joined Solidarity in suggesting the miner might need business assistance amid unresolved gold wage claims and an impending strike action. Sibanye-Stillwater meanwhile increased its strategic exposure to the circular economy by completing its 19.99% equity investment in New Century Resources.

Thungela Resources (-4.37%) and Kumba Iron Ore (-3.00%) also added to the commodities gloom and the 0.73% dip in the All Share index to 72,403.88 points. On the upside, small-cap coal miner Wescoal raced up 9.44% after the junior miner said in a trade update it expects a more than five-fold increase in interim headline earnings per share on an improved operational performance.

Commodity prices, meanwhile, changed course from their local market-close, but gold was still trading down 0.10% at $1,782.40/oz. Palladium and platinum, which were both softer at the end of local trade moved back into the green, adding 0.32% to $1,860.00 and 0.63% $962.50/oz respectively. Brent crude also moved higher in after-market trade to last change hands 0.94% higher at $76.04 a barrel. Sasol slumped 2.33%.

Continued caution toward tech stocks in China paused the rally in global tech stocks, with tech-heavy Naspers giving up 0.61%. Subsidiary Prosus stood firm, gaining 0.05%.

Financial services counters fared better, with Rand Merchant Holdings jumping 8.87% after the Outsurance parent said it has sold its 30% stake in UK short-term insurer Hastings Group for R14.6bn. RMH subsidiaries Discovery (+3.01%) and Momentum Metropolitan Holdings (+3.14%) also benefited from the news. Asset manager Ninety One gained 2.92%.

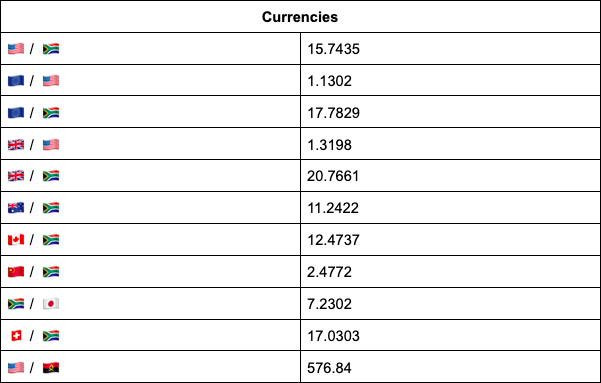

On the forex front, the rand enjoyed a robust run to last trade at R15.70 against the US dollar as markets digested the news that a third Pfizer vaccine shot could neutralise the omicron variant. The rand has been making small gains over the past few sessions, along with other emerging market currencies, with the Mexican peso leading the charge, according to TreasuryONE.

The unit was last trading at R15.70/$.

Indicators as at 17:00

Indicators brought to you by TreasuryONE.