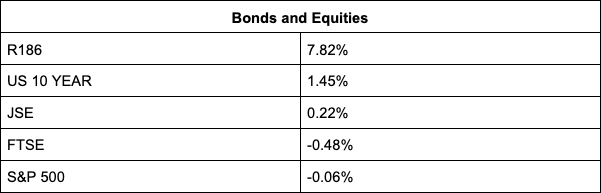

The JSE spent most of the day in the green before losing its footing just before the end of the trading day to close 0.11% down at 71,467 points as the US Federal Reserve’s tapering announcement looms large.

US futures opened steady on Wednesday but is slightly down with traders bracing for the Fed’s expected announcement that it will accelerate tapering.

And US retail sales missed expectations despite rising in November against the backdrop of the fastest rise in inflation for decades.

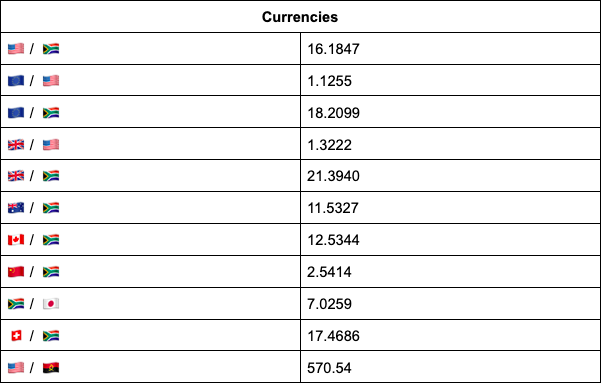

“The FOMC meeting has been the main driver of dollar strength for this week.

Emerging markets and commodities have all been under pressure as the market continues to be long of dollars in a tightening dollar market. The euro and pound have both been tracking sideways throughout the day as people sit on their hands,” comments TreasuryONE.

Meanwhile, Bloomberg reports that the South African government debt neared 100% of the National Treasury’s forecast for the fiscal year through March 2022 within seven months, heightening the risk that liabilities may overshoot official estimates.

According to the Reserve Bank’s Quarterly Bulletin gross debt amounted to R4.2 trillion, or 97.3% of the government’s estimate by October 31.

The Treasury revised its debt projection for the current fiscal year to R4.31 trillion, or 69.9% of gross domestic product, in last month’s medium-term budget policy statement from its February estimate of R4.38 trillion.

The bulletin also showed that there were foreign direct investment inflows of R557.9bn in the three months through September, compared with inflows of R17.4bn in the previous quarter.

The increase was largely due to the Prosus (-0.90%) acquisition of about 45% of Naspers (-1.38%) from the existing shareholders. On the other hand, portfolio investment outflows of R370.9bn were recorded in the third quarter, mostly due to non-resident investors exchanging shares held in Naspers for Prosus shares, Bloomberg reports.

The rand got hammered, with the unit last trading at R16.21 against the US dollar.

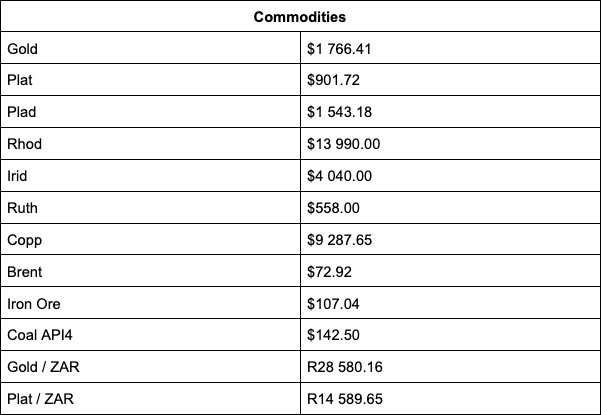

On the commodities front, gold stayed flat for most of the day, trading at $1,766.41/oz.

Gold counters were mixed, with Gold Fields gaining 1.21%, while AngloGold Ashanti ended 0.19% down. Platinum slipped 1.25% at $901.72/oz, and palladium also ended the day 3% down to $1,543.18/oz. Crude oil is down 0.5% to $74 a barrel.

Steinhoff gained a massive 22.57% in late trade after the embattled retailer announced that it reached a settlement with the former Tekkie Town owner claimants.

Before the news, the stock was still struggling as it digested the Financial Services Tribunal announcement that the Financial Sector Conduct Authority has found that former CEO Markus Jooste had contravened the Financial Markets Act.

Jooste encouraged trading of Steinhoff shares when he had inside information on the company.

Retail peers Homechoice (-16.57%), Woolworths (-0.44%), Pepkor (-0.60%), Mr Price (-0.60%), and Lewis (-1.03%) were all down, while Massmart closed 1.41% up.

Sasol ended the day down for the second day running, slumping 3.95% to R249.88 a share at closing as it continues to deal with yesterday’s news that it reduced production at its Secunda Operations.

Johann Rupert’s investment firm Remgro gained 1.4% after the firm received the nod for a second listing on JSE rival A2X early next year.

Source: TreasuryONE