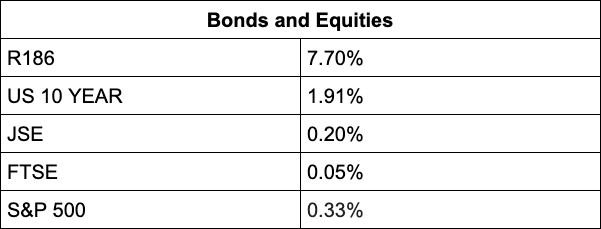

The JSE ended the week positively added 0.25% to leave the All Share Index on 75,206 points.

The US jobs report released on Friday showed that 467 000 jobs were created last month, much better than the expected 150 000 with the unemployment number sitting at 4%, which shows that more people are actively looking for jobs.

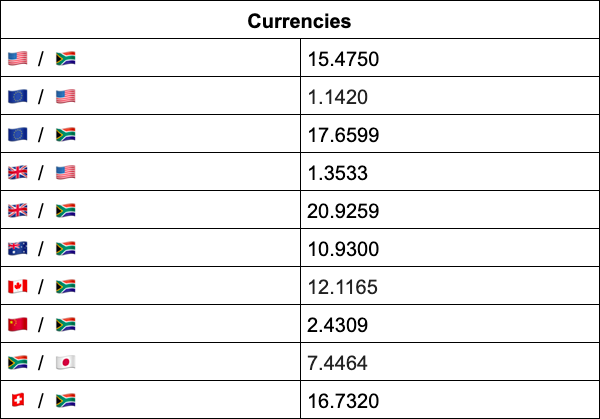

The US dollar gained some momentum when the numbers were released and began trading stronger while the rand weakened at the news.

“After opening the week around the R15.60 mark, we tested R15.20 a couple of times. This now becomes a pivotal level for the rand to break before we see further gains, with R15.70 key before further weakness will be on the cards,” comments forex trading house TreasuryONE.

The local unit was trading at R15.48 to the US dollar at last count.

FirstRand’s share price dipped marginally into the red today, losing 1.03%. FirstRand subsidiary, WesBank, has been reported by the Competition Commission to the Competition Tribunal for prosecution on Thursday, alleging that the finance house had colluded with Toyota Financial Services (TFS) South Africa.

Banking peers Standard Bank (-1.77%), Nedbank (-0.12%), and Capitec (-0.23%) all followed suit and ended the week in the red, while Absa (0.07%) bucked the trend.

Meanwhile, Moody’s says it expects the SA economy to grow by just 1.8% in 2022 amid political tensions and lack of business confidence due to “reform inertia”.

“Moody’s rates six commercial banks in SA — Standard Bank, FirstRand, Absa, Nedbank, Investec, and Bidvest Bank — all of which it assigns a ba2 rating with a negative outlook,” reports Business Day (for subscribers).

The Bidvest Group lost 1.69% today.

JSE heavyweight Naspers, which closed online classifieds website OLX this week, added 1.33% while tech division, Prosus, also ended the week positively, adding 1.31%

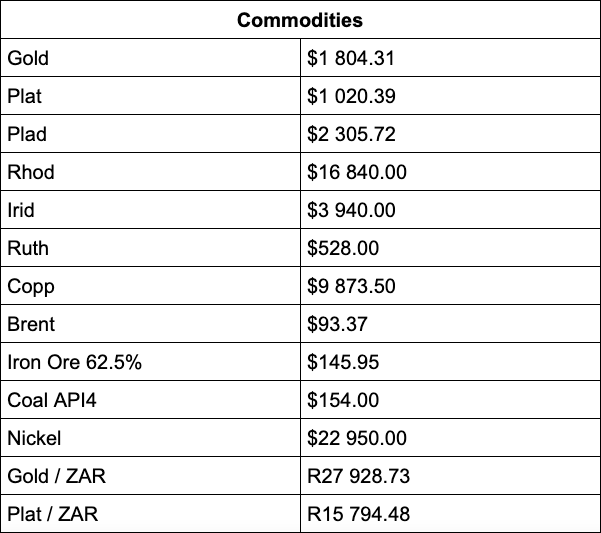

In commodities, gold was under some pressure after the US jobs numbers were released, dropping $10 but has since gone above the $1,800 mark. Platinum and palladium are trading at $1,020 and $2,305 respectively.

“Oil prices are moving from strength to strength as geopolitics and supply concerns continue to boost prices. Brent Crude is up a further 1.5% today and trades at $92.45,” says TreasuryONE.

Indicators as at 17:00

Source: TreasuryONE