(Bloomberg) — A passionate and bipartisan legislative effort to rein in the country’s largest technology companies collapsed this week, the victim of an epic lobbying campaign by Amazon, Apple, Google and Meta.

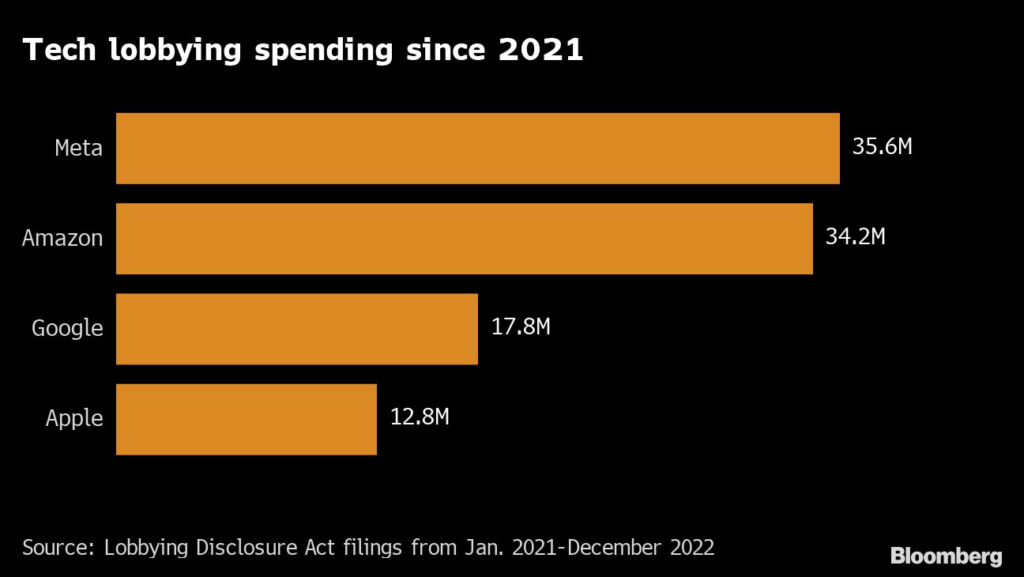

The internet titans spent hundreds of millions of dollars, sent their chief executives to Washington and deployed trade groups and sympathetic scholars to quash two antitrust bills co-sponsored by Senator Amy Klobuchar, a Minnesota Democrat, and Senator Chuck Grassley, an Iowa Republican. The companies treated the bills like an existential threat.The years-long US legislative effort, which harnessed outrage over tech companies’ power and dominance, would have cracked down on the practices of Alphabet Inc.’s Google, Amazon.com Inc, Meta Platforms Inc. and Apple Inc. for the first time in the nearly three decades since the internet was unveiled to the public.

The closely-watched bills advanced farther than any other antitrust overhaul in decades and emerged from an 18-month House investigation led by Rhode Island Democrat David Cicilline. The American Innovation and Choice Online Act would have prevented the tech giants from using their platforms to disadvantage competitors, while the Open App Markets Act would have pared back Apple and Google’s control over app stores.Despite an aggressive eleventh-hour push, the bills were not included in the end-of-year spending package released Monday, the final shot this year. The Senate included a narrower trio of antitrust bills in the end-of-year spending package. That legislation will give more money and resources to the country’s top antitrust regulators, marking the first time Congress has voted to expand antitrust enforcement measures in decades. But those provisions will not make the sweeping changes to the law that some advocates hoped for.

The companies have been forced to make significant changes in Europe to comply with similar European Union laws set to take effect in the coming years. US advocates believe that will happen here, too — but it will take time.

The opposition campaign exploited contrasting concerns of the two parties. To Democrats, tech lobbyists argued that the bills would harm minority groups and reduce online privacy. To Republicans, they focused on free speech and free markets.

Senate Majority Leader Chuck Schumer, whose daughters work for Amazon and Meta, declined to put the measures on the floor this session, saying they didn’t have the votes despite insistence from the bill’s co-sponsors that they did have enough support. Key Republican House leaders have made clear the legislation will not come up when they retake control of the lower chamber.

This account is based on 45 interviews with lawmakers, congressional aides, lobbyists, tech experts and advocates.

Factors in addition to lobbying led to the bills’ demise: partisan gridlock, personal animosity among lawmakers, bigger legislative priorities, a lack of action by Schumer and perceived inflexibility by Klobuchar. But the lobbying was titanic in scope.

“Big tech companies have spent hundreds of millions of dollars in a brazen attempt to thwart any progress on tech policy in Washington,” said Klobuchar spokeswoman Jane Meyer. She added that Klobuchar and the bill’s House and Senate co-sponsors “did not back down despite that onslaught.”

The bills had well-organized support. A coalition of smaller tech companies, civil society groups, and companies owned by Rupert Murdoch lobbied hard for them. Murdoch’s companies Fox and News Corp., which have long battled Google over its dominance in search and news distribution, worked to get Republicans on board. The small technology companies and consumer groups spent $2 million on ads, blanketed Capitol Hill and organized protest after protest.

It was no match for what they were up against.

The big tech companies put aside rivalries and joined forces. They and their trade groups spent more than $100 million on lobbying in two years, outpacing high-spending industries such as pharmaceuticals and defense. They donated more than $5 million to politicians, and tech lobbyists bundled more than $1 million to the PAC in charge of defending the Democrats’ majority. And they put millions more into dark-money groups, nonprofits and trade associations that aren’t required to disclose the source of their funding. Several congressional aides said they received more outreach on the bills than any other they’d worked on in years.

The companies poured $130 million into advertising campaigns, primarily targeting swing states such as Georgia, New Hampshire and Arizona, according to ad analytics service AdImpact. Many of the ads implied that Democrats could lose the Senate and Republicans could miss their chance at a legislative majority if they supported the legislation.

The campaign argued the bills would destroy Google Search and Amazon Prime and disrupt the global economy. Amazon and tech-funded nonprofit Connected Commerce brought dozens of small business owners to Washington to argue that they would suffer. Google tapped former national security officials on its payroll to say the bills could harm national security. Apple poured money into a free-market group, Taxpayers Protection Alliance, to launch the “App Security Project,” which argued that the bills would make phones vulnerable to hacking and spying.

The companies’ top executives worked the halls. Apple Chief Executive Officer Tim Cook and Google CEO Sundar Pichai met with members of the Senate Judiciary Committee, including Delaware Democrat Chris Coons, a close ally of President Joe Biden.

“There has been very forceful lobbying against this legislation,” Coons said in an interview. “Every one of us has seen dozens and dozens of TV ads, emails, social media posts.” He added that he sympathized with some of the tech leaders’ concerns, including arguments that the bills could harm US competitiveness with China.

During markup, the American Innovation and Choice Online Act passed 16-6. But a handful of Democrats, channeling big tech talking points, asked Klobuchar to address their concerns.

The coalition of small tech companies – including Yelp Inc., DuckDuckGo and Proton AG – joined civil society groups, creating an “anti-big tech” infrastructure, meeting every Friday to strategize. “It was a historic moment,” said Kate McInnis, senior public policy manager at DuckDuckGo.

The Open App Markets Act passed the Senate Judiciary Committee 20-2 in early February, but ruptures emerged. During the markup, conservative Louisiana Republican John Kennedy criticized Klobuchar. “I’m tired of being told that if I ask a question, I’m in the pocket of big tech,” Kennedy said.

He later told allies he was out. “You don’t generally convince senators by trying to force feed them,” Kennedy said in an interview. “They just either gag or spit it out.” Though Grassley counted 20 Republican votes, more GOP senators dropped their support.

Beginning in February, senators including Coons, Vermont Democrat Patrick Leahy, and Georgia’s Jon Ossoff suggested tweaks on issues including privacy and cybersecurity, many of them initially raised by the companies. They found Klobuchar’s office unwilling to make significant changes.

Klobuchar’s office said it made over 150 changes to her legislation, some based on feedback from other offices.

Meanwhile, the flood of ads surged in swing states with vulnerable Democrats.

They served their purpose. New Hampshire’s Maggie Hassan and Arizona’s Mark Kelly urged Senate leadership to delay putting the bills on the floor before the elections.

By March, Schumer’s office pledged to bring the legislation to the floor but told the bills’ advocates that they had to prove they had the needed 60 votes.

Later in the spring, a group of internet law academics, some of whom had received funding from Google, argued the bill could affect the tech companies’ ability to remove misinformation and hate speech from their platforms. This proved deadly.

Four Democratic senators began to press Klobuchar to amend the legislation. Her staff negotiated new language. But the trade-off was fatal: If Klobuchar made speech-related changes, the bill would lose Republicans. Without the changes, Democrats walked.

Supporters kept up momentum into the fall with protests, ad campaigns, public letters and Capitol Hill meetings. But by November, when Klobuchar attended a book party, it was increasingly clear that the battle was over. She addressed the party, saying that she would “try” to pass the legislation.

Cicilline said he was “frustrated” that Schumer did not ultimately put the bills on the floor for a vote. “It’s just wrong,” he added.

Advocates are already regrouping, filled with hope.

“Big tech is delaying the inevitable, and the bigger fight continues,” said Alex Harman of the Economic Security Project. “They aren’t winning, they are just losing in slow motion.”

(Updates with narrower antitrust bills in the year-end spending package in fifth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.